Updated 9 a.m. – A group of school districts and parents filed a lawsuit Friday arguing that the device used by the legislature to control annual K-12 spending, the so-called negative factor, is unconstitutional.

The suit, filed against the state in Denver District Court, argues that the negative factor violates Amendment 23, the constitutional provision that requires school funding to increase by inflation and enrollment growth every year.

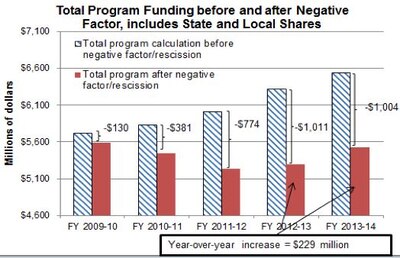

The suit has been expected for some time and opens a new front in the policy war over the negative factor, a conflict that intensified during the 2014 legislative session. It’s estimated that use of the negative factor has cut about $1 billion a year from what school districts otherwise would have received for basic operating costs. (See text of suit here.)

The plaintiffs ask that the negative factor section be stricken from the state’s school funding law and that the legislature be barred from reinstating the factor in another form. The suit does not ask that lost funding be restored.

Lead lawyers in the case are Timothy Macdonald of Arnold and Porter and Kathleen Gebhardt of Children’s Voices, a Boulder public interest law firm. She was the lead lawyer in the long-running Lobato v. State school funding suit, which was thrown out by the Colorado Supreme Court in 2013. (Get full background on the Lobato case here.)

Gebhardt told Chalkbeat Colorado that the final decision to file was made on Tuesday, partly because recent state revenue forecasts (see story) indicate continued improvement in state finances.

“It’s a simple claim, just that the negative factor violates Amendment 23,” Gebhardt said, describing it as a very different case from the complex Lobato suit.

The plaintiffs in the new case include the Colorado Springs 11, Boulder Valley, Mancos, Holyoke and Plateau Valley school districts, along with the East Central Board of Cooperative Educational Services. Other plaintiffs are the Colorado Rural Schools Caucus and the Colorado PTA. Four sets of parents with children in the Kit Carson, Lewis-Palmer and Hanover districts also have signed on to the suit.

The lead plaintiffs are Lindi and Paul Dwyer, who have four daughters in the Kit Carson district, and the case takes their name, Dwyer v. State. Gov. John Hickenlooper and Education Commissioner Robert Hammond are the named defendants in the suit.

Lawyers from four Denver law firms have agreed to assist Gebhardt with the case without charge.

What Amendment 23 does

Passed by voters in 2000, A23’s backers intended for it to provide a predictable and growing source of funding for schools. The amendment’s goal was to restore per-pupil funding to 1988 levels over time. For the first 10 years after passage the amendment required that funding increase an additional 1 percent a year on top of the increases for inflation and enrollment.

State funding for schools comes in two chunks. The larger amount, base funding, provides an identical per-student amount to every district. The second chunk, called factor funding, gives districts varying additional per-student amounts based on district characteristics such as numbers of at-risk students, low enrollment and cost of living for staff. Local property and vehicle tax revenues also contribute to what’s called total program funding for schools.

(A third, smaller pot of state support known as categorical funding provides money to districts for programs such as special education, gifted and talented and transportation. While A23 requires overall categorical funding to increase by inflation every year, the money is not distributed by the same formula that governs total program funding.)

The key fact is that up until the 2010-11 school year, the legislature applied the inflation-and-enrollment increase to both base and factor funding. (Because of the recession, in 2008-09 and 2009-10 the legislature cut school funding by other means.)

Behind the negative factor

With the economy still squeezing state revenues, in 2010 the legislature created the negative factor (originally called the stabilization factor) to control school spending as lawmakers continued to struggle with the overall state budget. It applied to the 2010-11 K-12 budget and has been in effect ever since.

The legal reasoning behind the negative factor is that A23 applies only to base funding, not to factor funding. And while the original A23 factors are intended to increase school funding, the negative factor gives lawmakers a tool for reducing it. This is the key issue under attack in the new lawsuit. The negative factor hasn’t been tested in court before. Its rationale is based on a 34-page 2003 memo issued by the Office of Legislative Legal Services at the request of then-Rep. Keith King, R-Colorado Springs. (Read memo here.)

“Amendment 23 precludes the General Assembly from purporting to grow the base but then slashing overall education funding by fundamentally revamping or jettisoning the [finance] formula as in effect in 2000,” the suit argues.

The policy debate

A23 isn’t the only constitutional provision that applies to the state budget. Among other things, the constitution requires a balanced state budget every year, limits the amount of new revenue that can be spent even in years of high growth and restricts property taxes in a way that has reduced growth of local district revenues.

Because of those restrictions, policymakers who support the negative factor argue that it’s necessary to prevent K-12 spending from consuming larger and larger shares of the state’s general fund budget and squeezing out other state programs.

With state revenues improving, reduction of the negative factor was the top priority for education interest groups during the 2014 legislative session. Their proposals ranged as high as $275 million. In the end lawmakers agreed to a $110 million reduction.

The Hickenlooper administration and legislative budget experts resisted a larger buy down, arguing that a bigger amount would put too much pressure on the state budget in future years. That can happen because reducing the negative factor puts more money into K-12 base funding, which is subject to A23’s multiplier in the future.

Lawsuit backers met with key lawmakers near the end of the session, but legislators reportedly refused to be swayed by any possibility of a suit.

What happens next

As usually happens in these kinds of constitutional cases, the attorney general is expected to ask the district court to dismiss the suit. If that happens, the plaintiffs would appeal to the Colorado Court of Appeals.

Assuming the case stays alive in district court one way or another, both sides could file their written arguments by the end of the year – creating a pile of legal documents for the 2015 legislature to ponder as lawmakers consider the 2015-16 budget and how big a negative factor to include.

Interest groups already are gearing up to push for additional factor buy downs in 2015, and a live lawsuit will provide additional fuel and tension for the debate.