Colorado’s 100 lawmakers return to the Capitol this week facing a budgetary squeeze and some important unfinished education business.

The budget is expected to dominate debates this year. Many lawmakers are looking for a way to work around constitutional restrictions that may require taxpayer refunds even as some state programs face cuts. The outcome will carry important implications for school districts and state colleges and universities.

Beyond money, protection of student data already is teed up to be a major education issue this session, as it was last year. Testing, school ratings and teacher evaluation also are expected to be in play.

Some Capitol observers think 2016 could be as busy as the 2015 session, when nearly 120 education-related bills were introduced. The vast majority died.

The Capitol cast of characters looks much the same as 2015. Republicans hold a one-vote majority in the Senate while Democrats control the House. The membership of the House and Senate education committees remains largely the same.

Lawmakers are more seasoned than last year, when a fifth of the 100 members were freshmen. But 2016 is an election year, which creates partisan dynamics that can make compromise harder.

Handicapping a legislative session is tricky, but here’s a look at the education issues taking shape for 2016.

The big issues

Budget & school finance

“Our budget is our biggest challenge this year,” Democratic House Speaker Dickey Lee Hullinghorst of Boulder told reporters at a recent briefing. “We are going to have to cut education this year if we don’t find a solution.”

Gov. John Hickenlooper’s proposed 2016-17 budget includes such cuts, including a $50 million increase in the K-12 “negative factor.” That’s the formula the legislature uses to reduce school funding from what it otherwise would have been in order to balance the overall state budget. The budget also calls for a $20 million cut in higher education support and recommends that college and university boards be free to raise tuition rates as they see fit.

Here’s the dilemma lawmakers face: A formula mandated by the state constitution limits annual increases in spending. Revenues that exceed the limit are supposed to be refunded to taxpayers, and that’s the situation Colorado now faces.

Those revenues include both taxes, which can spent at the legislature’s discretion, and various revenues called “cash funds,” which generally can be used only for specific purposes.

A $750 million chunk of cash is generated by something called the hospital provider fee, which is used to support the Medicaid program.

Hickenlooper and Democratic leaders want the legislature to change the provider fee so that it doesn’t count against the revenue limit, freeing up tax revenues for spending on things like transportation and education and eliminate the requirement for taxpayer refunds.

But Republican leaders last week hardened their opposition to reclassifying the provider fee, casting new doubts on whether a deal can be struck.

Education advocates also are eying another pot of money as a way to ease the pressure on school and college funding.

Total school funding — $6.2 billion this year — comes from a combination of state and local tax money. If there’s more local revenue than projected, the state is able to reduce its share. District property tax revenues are higher than projected last spring, and enrollment is down, meaning the state could cut its contribution by about $159 million in the middle of the current school year.

Districts will fight to keep that money for their budgets, but some lawmakers will argue that state support should be cut for the current year so the money can be saved for the 2016-17 budget.

Both Republicans and Democrats are pledging to keep the negative factor at is current $855 million.

“It will not be my intention to let the negative factor grow,” said Rep. Millie Hamner, D-Dillon at a recent legislative forum sponsored by Chalkbeat. (Listen to the audio of that event.) She’s the chair of the Joint Budget Committee and will be a sponsor of the 2016-17 school finance bill.

Many observers are skeptical there will be major movement on school finance.

“It’s just very bleak, how we are going to fund education,” said Jane Urschel, deputy executive director of the Colorado Association of School Boards.

Data privacy

The spread of online testing, use of new tools to evaluate the readiness of preschool and kindergarten students and the proliferation of classroom apps have generated a lot of anxiety among some parent groups and policymakers.

A bill intended to impose greater privacy and security requirements on software and service vendors died in the 2015 session after lawmakers couldn’t reconcile a stronger Senate bill with a somewhat softer House version.

The issue is back this year, with Republican Rep. Paul Lundeen of Monument and Democratic Rep. Alex Garnett of Denver trying to reconcile the wishes of parents, school districts and the software industry.

The key questions are disclosure of what data is collected, how it’s protected, whether it can be sold or shared, how long student data is retained and whether personal information about individual students can really be protected when data is aggregated.

Any legislation on data privacy will need to walk a fine line between protecting student privacy and not stifling educational innovation. “This is an extremely heavy lift,” Lundeen said.

Sen. Chris Holbert, R-Parker, was the author and would-be broker of last year’s unsuccessful data privacy bill. He’s not closely involved in the issue this year, but feels, “We have a better chance.”

Garnett, Lundeen’s partner in the effort, said the state “can’t go another year without putting some guardrails” on data privacy.

Testing, ratings & evaluation

There’s rising chatter about assessments and how test results are used, but no big initiatives have jelled yet.

Here are the key questions in the air:

- Will the legislature revisit testing issues in 2016, perhaps sparked by the controversy over whether SAT tests should replace ACT tests that have been given to all high school juniors?

- Will recent changes in federal education law – the new Every Student Succeeds Act – prompt lawmakers to try to take advantage of the additional flexibility the federal government has given states?

- Will there be moves to extend current timeouts in use of state testing data for rating districts and schools and in evaluating teachers?

- Will the relatively high rate of opting out of last spring’s PARCC tests raise doubts about the reliability of that data in rating schools and evaluating teachers?

There’s talk about testing bills, including proposals to eliminate 9th grade testing and perhaps pull Colorado out of the PARCC tests. A couple of legislators say they’re “looking into” the switch to SAT tests for 11th graders, which is all but certain to be delayed until spring 2017.

But it’s unclear whether such ideas will go very far.

“I don’t think there will be a lot stomach in the legislature to deal with more testing bills,” said Sen. Andy Kerr, D-Lakewood.

A similar air of uncertainty hangs over possible changes to the accountability and evaluation systems.

There likely will be bills to exempt teachers in early elementary grades and nationally board certified teachers from some provisions of the teacher evaluation law. There’s also talk of trying to change the current law’s requirement that 50 percent of teacher evaluations on student academic growth.

Whether lawmakers tackle those issues in a serious way may depend on how they look at the reliability of last spring’s PARCC testing results.

In a recent meeting with lawmakers, interim education Commissioner Elliott Asp defended the PARCC exams as “well designed” and “valid.” But he acknowledged “what makes the data questionable” for use in rating districts and schools is the participation rates.

The testing law passed last year requires the Department of Education to recommend to the legislature’s education committees whether the accountability timeout should be extended, based on whether test results can be used fairly. The department hasn’t yet made a recommendation.

Colleges also face a money pinch

School districts would receive an increase in funding next year under Hickenlooper’s budget, even they wouldn’t get all the money they want because of the proposed increase in the negative factor.

In contrast, state colleges and universities would take an actual cut of $20 million in their state support.

During meetings with the Joint Budget Committee last week, college presidents gently suggested that lawmakers find money to avoid those cuts. But higher education leaders are realistic about what’s possible.

“If there’s a cut, let’s just take the cut and move on,” said University of Colorado President Bruce Benson.

Tuition increases, the inevitable side effect of state budget cuts, likely will the big higher education issue of 2016. The Hickenlooper administration is proposing that college trustees be given full discretion to raise tuition. A 6 percent annual cap on tuition hikes imposed by lawmakers two years ago is expiring.

Statehouse observers expect bills to set a new cap will be introduced. “It’s low-hanging fruit,” said one lobbyist.

Other issues to watch

Despite perennial promises to restrain themselves, lawmakers love to introduce bills about schools. Here’s a sampling of other issues that are being bandied about at the Capitol:

Charters – Lobbyist Dan Schaller of the Colorado League of Charter Schools said the group is looking at a legislative package to deal with charter funding inequities. Schaller said the league hasn’t decided what it might propose on the touchy issue of districts’ authority to authorize charters. A measure to reduce those powers died last year.

Concurrent enrollment – More than 20,000 Colorado high school students take college classes, and some lawmakers would like to boost that number. Lundeen said he’s planning a bill on the issue. The trick is figuring out how to split student funding between school districts and community colleges.

Construction – State aid for building and renovating schools has plateaued ever since the Building Excellent Schools Today program reached its annual cap on debt repayments a couple of years ago. BEST board members are pushing for an increase in that $40 million cap. They may get a sympathetic ear, because some lawmakers now are more comfortable with the stability of marijuana tax revenues, a small portion of which go to BEST.

Early education – Recent efforts to increase funding for the state preschool program and for full-day kindergarten have fallen afoul of budget realities. That doesn’t mean the issue won’t be debated again this year as both Wilson and Kerr promise bills on full-day kindergarten.

School safety & district liability – The 2015 legislature passed a law that make school districts liable, in some cases, for violent acts committed on school grounds. Districts were nervous about the idea from the start, even the law doesn’t fully go into effect until next year. A legislative study committee took a lot of testimony about the law over the summer but recommended no changes. Districts still want more specificity about what they should do to keep students safe, but it’s unclear if legislation will be proposed or be successful this year.

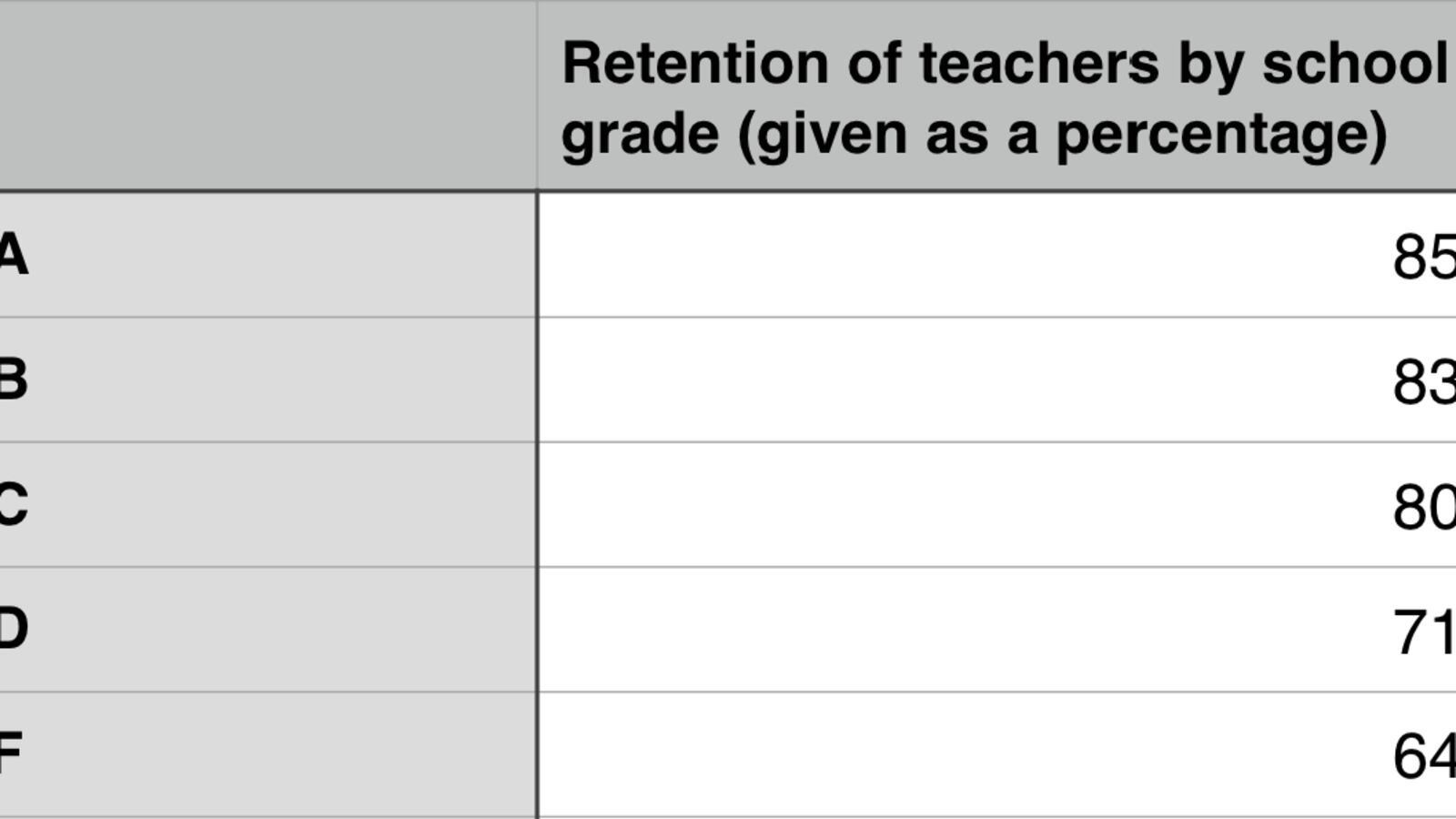

Teachers – Expect to see a bill to change the current law requiring mutual consent for placement of teachers in schools. This has been a sore subject for teachers unions, particularly in Denver, for five years. But previous attempts to change this portion of the teacher evaluation law have gone nowhere. And heightened worries about teacher shortages, particularly in rural districts, are expected to prompt legislation intended to help teacher recruitment and retention. This is another issue where lack of money may stymie meaningful action.

But wait, there’s more …

Here’s a quick list of other education ideas and issues that are in the air as the session prepares to kick off: Reduction of the paperwork and data reports districts have to file with CDE, expansion of blended learning opportunities, possible tweaks to current school readiness and graduation guidelines requirements, a bill on suspension and expulsion of children in early grades, resident tuition eligibility for homeless students, STEM and career and technical education, adjustments to the breakfast-after-the-bell law, changes in regulation of multi-district online schools, tax credits for donations to private school scholarships and limits on campaign contributions to school board candidates.

If most of those sound familiar, they should. Almost every education issue in play this year has been kicked around in previous sessions. Of course, most of those bills have died, which is why they’ll be back this year. Hope springs eternal at the Capitol.

Need to refresh your memory about what lawmakers did and didn’t do last session? Check this article.