Denver voters easily approved two tax measures on Tuesday that will raise $628 million to benefit the city’s public schools. Ballot Issues 3A and 3B were passing with about two-thirds of voters supporting the measures according to preliminary results. The victories continue a long tradition of Denver taxpayers opening their wallets to fund education.

Ballot issue 3A is a $56.6 million tax increase, known as a mill levy override, to fund certain Denver Public Schools programs, teacher training and school staff. Ballot issue 3B is a $572 million bond issue to pay for building new schools and repairing existing ones.

The bond issue isn’t expected to raise the current property tax rate, due in part to rising property values and decreasing school district debt. The mill levy override is expected to cost taxpayers an additional $9 per month, or $110 per year, for a Denver home valued at $329,000.

Knocking on doors in the family-friendly Stapleton neighborhood four hours before polls closed, campaign organizer Cameron Brennan encountered lots of supporters. One woman danced on her porch.

“We’re in! We’re in!” she said. “You haven’t run into anybody who’s voting ‘no,’ have you?”

Denver Public Schools staff, school board members and campaign volunteers gathered at a downtown restaurant to watch the returns. When the first preliminary results rolled in at 7 p.m., there were hugs and high-fives all around.

“This election is really about opening a window of opportunity for our kids by providing them and their teachers with the supports they need the opportunities to learn in the learning environments they deserve,” Superintendent Tom Boasberg said.

School board president Anne Rowe thanked Denver voters for believing in kids. “In this bizarre world we’re in right now, this is the most inspiring thing,” she said.

This was a record year for school tax measures across Colorado, with 44 districts asking voters to approve a combined $4.4 billion in the face of state education funding that has been slow to recover from the Great Recession. Denver’s $628 million ask was the biggest in Colorado.

Here’s a rundown of how that money is slated to be spent:

— $252 million in bond money for school maintenance, including $70 million for cooling solutions at DPS’s hottest schools, the hottest of which reached 94 degrees indoors last fall.

— $142 million in bond money to build new schools and expand five “proven programs” — three district-run schools and two charter schools — that are currently overcrowded.

— $108 million in bond money for classroom updates, including remodeling the district’s “baby boomer-era” schools such as George Washington High School.

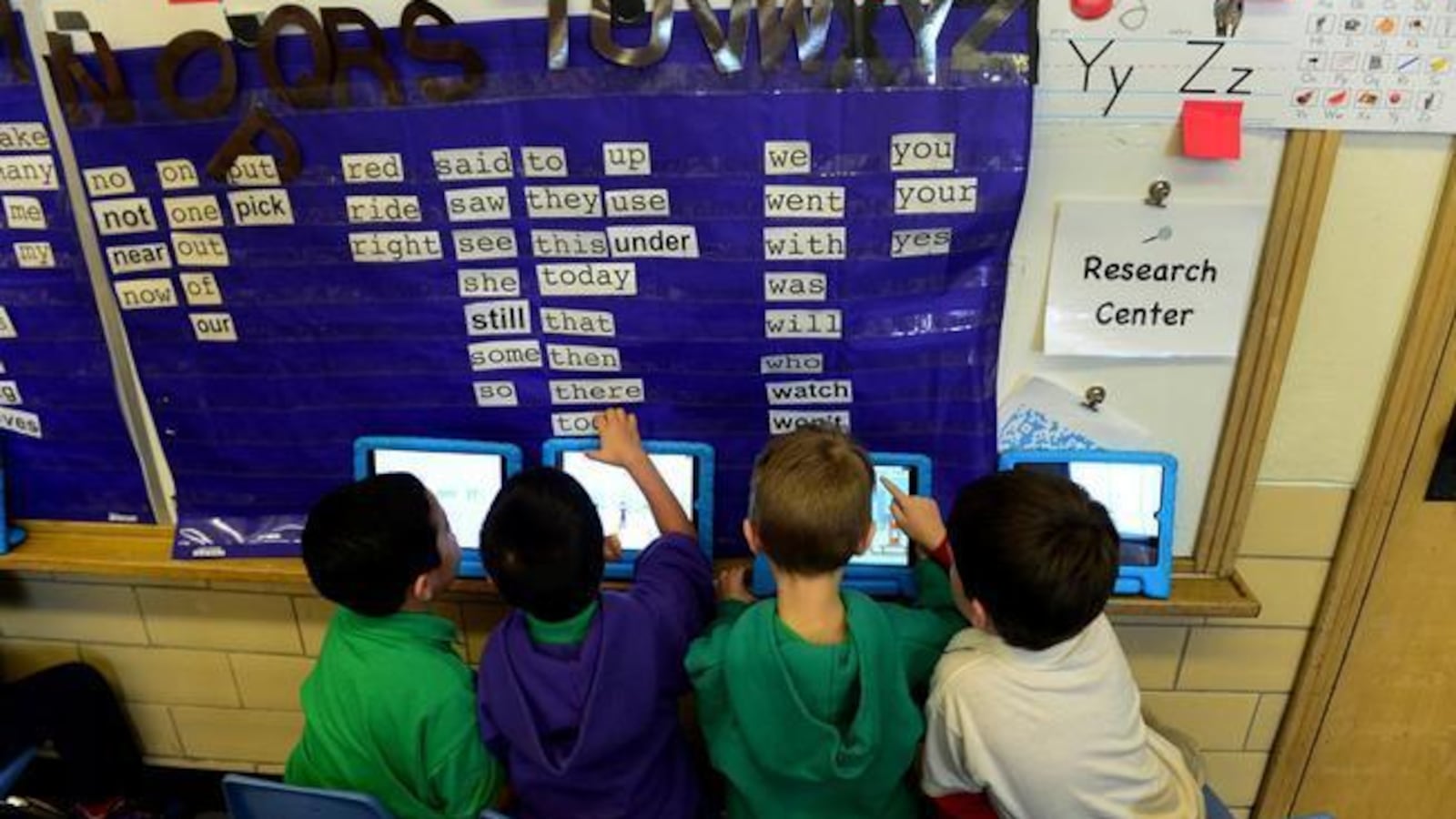

— $70 million in bond money for technology, including to increase the number of schools that have a computer or tablet for every student.

— $15 million in mill levy money for “whole child” initiatives, including hiring more school psychologists, social workers and nurses

— $14.5 million in mill levy money for teacher programs, including one in which teachers coach their peers and one that recruits paraprofessionals to become teachers partly in an effort to increase the diversity of the workforce, which is mostly white.

— $8 million in mill levy money for programs that help students get ready for college or careers, including a new statewide apprenticeship program in which DPS is participating.

— $6.8 million in mill levy money for early literacy efforts, including providing more training in reading instruction to teachers who teach preschool through third grade.

Denver voters have historically been receptive to raising taxes to benefit schools. Voters approved a bond issue in 2008, and both a bond issue and mill levy override in 2012.