The improving economy continues to pump increased revenues into the state’s coffers, but constitutional limitations likely will reduce how much of that money lawmakers can spend during the 2015 session.

That could make it harder to whittle down the negative factor, the state’s $900 million shortfall in K-12 spending, and to provide more funding for programs like expanded preschool services and full-day kindergarten.

The latest quarterly revenue forecasts were presented to legislative leaders and Joint Budget Committee members Monday morning by economists from the governor’s Office of State Planning and Budgeting and the Legislative Council, the General Assembly’s research arm.

“We did increase our expectations for general fund revenue,” said Natalie Mullis, the legislature’s chief economist. In theory, she said, lawmakers could have $1.05 billion more to spend on the 2015-16 budget than what’s being spent in the current, 2014-15 budget.

“It’s not enough money to fund everything that every interest group is going to bring to you,” Mullis cautioned, to laughter from lawmakers. The basement Capitol hearing room was packed with lobbyists, the very people Mullis was referring to.

The challenge is created by the Taxpayer’s Bill of Rights, commonly known as TABOR, which sets ceilings on the amounts of revenue the legislature can spend each year. The state hasn’t hit the so-called TABOR limit for several years, but now revenues are growing fast enough that Mullis’ team estimates the state will owe taxpayers $120.3 million out of the 2015-16 budget and $620.4 million in 2016-17.

The OSPB has similar but somewhat different forecasts, including a projection that a $196.8 million refund will be required from surplus revenues in the current budget, plus $186.5 million in 2015-16 and $269.2 million in 2016-17. (Refunds would be made through a variety of mechanisms, including earned income credits, sales tax rebates and a temporary reduction in income tax rates.)

“We should plan for exceeding the TABOR limit in fiscal year 2014-15,” OSPB director Henry Sobanet told lawmakers. He also warned that the combined budget demands and spending restraints “will combine for an extremely tight environment” in 2016-17 and that lawmakers may not be able to spend much more in that year than they do in 2015-16.

And, a different provision of TABOR also will require lawmakers next year to make a $58.7 million rebate of some marijuana revenues. The mechanism for doing that hasn’t been determined.

The prospect of TABOR refunds worries education advocates, who would like some surplus revenues diverted to further reduce the negative factor. The 2014 legislature made a $110 million dent in the shortfall and stipulated that the negative factor couldn’t grow in the 2015-16 budget. Gov. John Hickenlooper has proposed that the negative factor be trimmed another $200 million in 2015-16 – but that cut would apply only for one year.

School district leaders say they’d be happy with the one-time cut but would be even happier if the negative factor were reduced permanently. A group of superintendents has proposed an additional $70 million in K-12 spending in 2015-16, $50 million focused on at-risk and $20 million for rural districts. Both the governor’s and the superintendents’ proposals have been received somewhat coolly by JBC members, even before Monday’s forecasts were issued.

The legislature can avoid making the TABOR refunds and keep excess revenues, but only by proposing a ballot measure seeking voter approval to do that. Putting a measure before voters requires passage in each chamber, something that might be a long shot, given split party control of the legislature. Hickenlooper also has indicated he supports the refunds, at least for now.

Districts may not get extra money in current year

Legislative economists also told lawmakers that it appears a mid-year adjustment in 2014-15 K-12 funding won’t be necessary because the enrollment projections made last spring were higher than actual enrollment this fall. Total enrollment was only 163 students fewer than expected, and the actual number of at-risk students was down about 4,560 (1.5 percent) from the projection made last spring.

Enrollment is the key variable in the school finance formula, and the actual student count regularly exceeds annual estimates, meaning lawmakers often give schools extra money in February or March.

That isn’t the case this year, and Legislative Council staff said that might give lawmakers the opportunity to make a $14 million mid-year reduction in the negative factor. (See the document at the bottom of this article for more details.

Forecast indicates past K-12 growth rates will continue

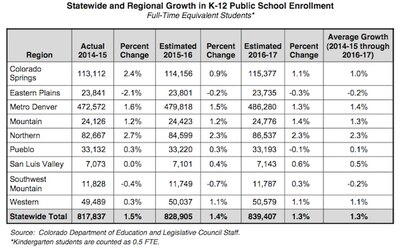

The December forecast from legislative staff always includes a two-year projection of K-12 student enrollment trends.

This year’s analysis found that enrollment grew 1.5 percent in the current school year and is expected to grow 1.4 percent in 2015-16 and 1.3 percent in 2016-17. Those rates are similar to the growth seen in recent years.

The largest rates of growth are expected in northern Colorado followed by the Denver metro area, with smaller increases in students elsewhere in the state and even slight declines in some regions.