Tennessee’s largest school district is honing in on a reduced $941 million budget for its fiscal year beginning July 1, but the process thus far has been clouded by a lack of specifics behind various cuts floated by administrators.

After a month of wrangling, and with only about two weeks left to present a final spending plan to the Shelby County Commission, the school board for Shelby County Schools heads into its final budget review Wednesday with more questions than answers shared in public forums. A vote is scheduled for next Monday.

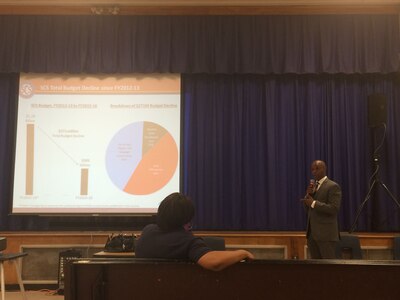

The process began in early April as Superintendent Dorsey Hopson declared a projected $86 million deficit — with nowhere to cut but the classroom — and outlined $50 million in proposed cuts, with the hope that the County Commission would cover the remaining $36 million shortfall. The cuts included several prized programs that no one, including Hopson, expected to stick due to the academic gains they’ve fostered and the built-in constituencies that immediately protested. In the ensuing weeks, the school board voted to close six more schools to protect those programs, but few details about the overall budget have emerged since.

At a community budget meeting on Monday, Hopson disclosed without explanation that the gap between proposed cuts and the remaining shortfall has been reduced from $36 million to $28 million.

But even the reduced shortfall is far more than county officials have indicated a willingness to cover. Shelby County Mayor Mark Luttrell is proposing a funding increase of only $8.7 million for the county’s seven school districts, of which Shelby County Schools would receive about 78 percent.

Numerous other questions about Shelby County Schools’ budget remain going into the homestretch:

- Will teachers get a raise? The perennial topic wasn’t discussed by board members during budget meetings, but Chairwoman Teresa Jones said Monday that the board is committed to giving teachers a salary increase of between a 1 to 3 percent, depending on how much the County Commission is willing to increase funding to the district.

- How many people could lose their jobs? When Hopson first proposed $50 million in cuts, the administration listed a summary of areas to cut including some special education teachers, career and technical education instructors, world language teachers, and employees providing educational services to students in juvenile detention. Some of those positions are vacant, others are not. But district leaders have yet to disclose the total number of employees who would lose their jobs if the current spending plan is approved.

- How would proposed changes to the district’s employee health insurance plan impact teachers and retirees? Throughout the process, the one constant has been an assumption that the district would adopt a cost-saving plan similar to that used by Shelby County government. Hopson said last month that the plan has “much higher deductibles” than the district’s current plan but significantly lower premiums, which would translate into higher take-home pay for employees. On Monday, Jones called the drop in premiums “marginal” and said retirees likely would be most impacted under the proposed change. The district has not disclosed specifics.

- Are the savings from recently approved school closures enough to offset the initial proposed cuts for the Innovation Zone, CLUE and guidance counselors? The speedy decision to begin closure processes for three district-run schools and revoke the charters of three others was based not only on the poor academic record of the schools but also cost savings to restore funding for the CLUE program for gifted students, the iZone school turnaround initiative and guidance counselors. But the original proposal was to close 10 schools at an estimated savings of up to $8 million, and administrators have not provided a new estimate for closing only six. The original cuts to CLUE, the iZone and guidance counselors totaled $7 million.

From the beginning, the budget process has been short on publicly shared details. Reporters’ repeated attempts to obtain a copy of the initial proposed spending plan have been dismissed as the district cites ongoing changes to the proposals.

“In the first meeting, (Chief Academic Officer Heidi) Ramirez laid out all of the proposed cuts that we were facing at the time, and we were basically throwing things up in the air, if you will, so we could get a really good feel from board members as far as what they would support and what they wouldn’t,” explained district spokeswoman Natalia Powers.

Asked for specifics about cost savings from school closures, Powers referred to an explanation from district finance chief Lin Johnson. “… Along this process, there’s a lot of cleanup that takes place, in the sense that just little things that are found along the way that adjust and change the numbers a little bit,” she said.

At Monday’s community budget session, the lack of specifics was problematic for Aleace Scott, a kindergarten teacher at Hickory Ridge Elementary School and one of the few people to show up. She said she tries to keep up with school board decisions, but thinks teachers won’t have complete information before a budget is approved.

“Now, all I hear about the budget is what you’re cutting,” she said of the district. “We need to be involved in the whole process, not just when you’re talking cuts… (District leaders) need to be more transparent about what’s going on.”