One Memphis school targeted for closure will stay open an extra year, while a second school also may get a reprieve after the school board tweaked and approved Shelby County Schools’ $954 million general fund budget for next year.

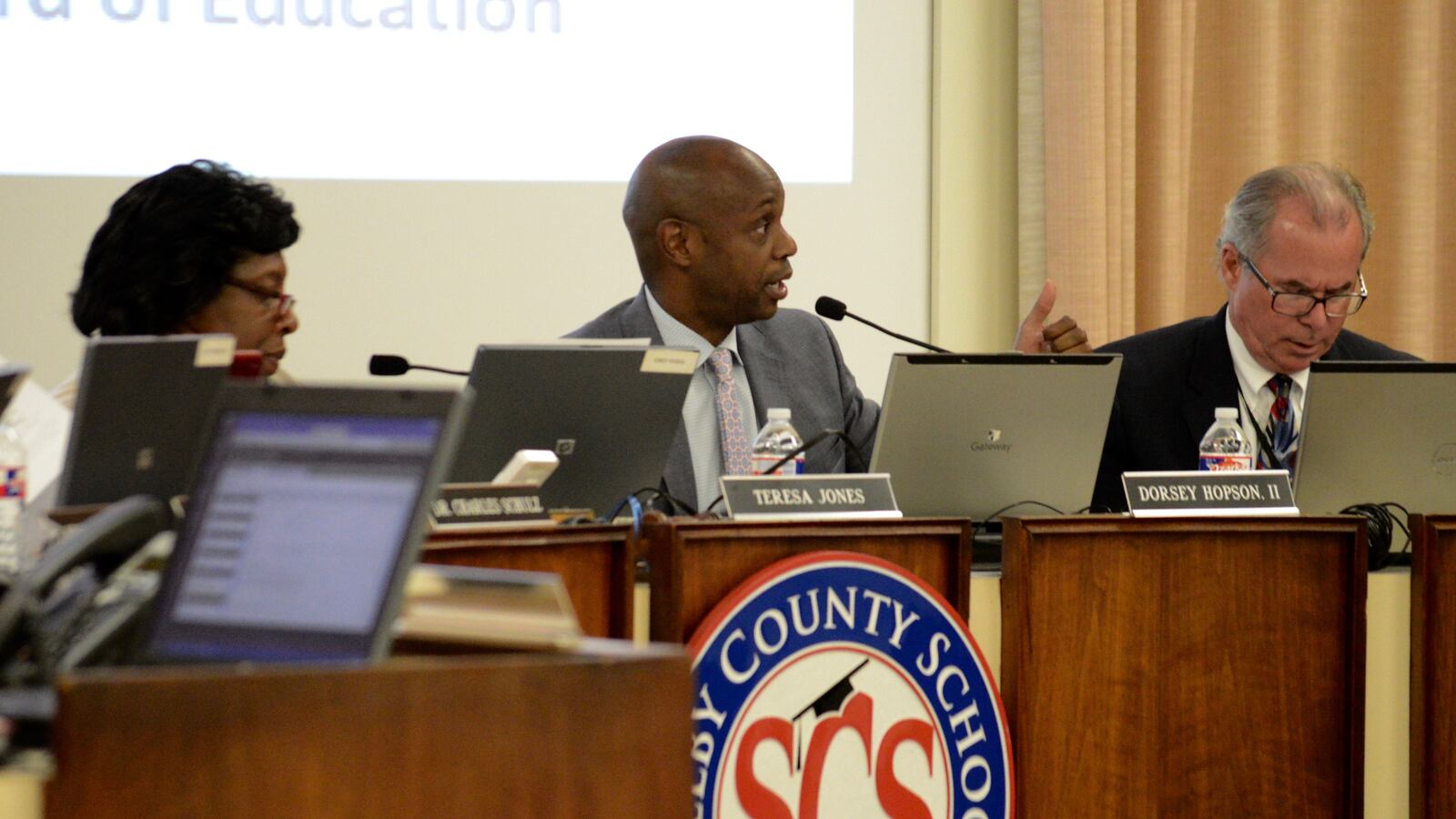

The 5-3-1 vote Monday to amend Superintendent Dorsey Hopson’s school closing plan means that Northside High School will be shuttered at the end of the 2016-17 school year instead of this year.

Board members also agreed to delay a vote on closing Carver High School until they can examine a community report that outlines alternatives for keeping the 59-year-old downtown-area school open.

The votes came as the board finalized its 2016-17 spending plan, which includes a 3 percent raise for top-tier teachers and a switch to a yet-to-be-determined health insurance plan for employees and retirees.

The approved budget, which includes a $35 million funding gap, means the board will ask the Shelby County Commission to make up the difference, even though several commissioners have previously indicated that’s too tall of an ask. District leaders are scheduled to present their budget to the commission on May 25.

But board member Stephanie Love said the district should ask for even more to avoid the $45 million in cuts included in the approved budget. “Let the County Commission tell us they don’t want to fully fund what we need,” she said. “Let them tell us no.”

Hopson hopes the decision to close two other schools and switch insurance plans demonstrates that the district “is not afraid to make tough decisions.”

“Given the markers of success, and given the tough decisions that we made, [we hope] that the County Commission will find it wise to provide for these kids,” Hopson said after the meeting.

The board had approved closing Northside and Carver last month on a preliminary vote, but shuttering a district-run school requires two votes. With little discussion and no explanation, Chairwoman Teresa Jones moved to amend Hopson’s closing plan for Northside, while board member Mike Kernell moved to delay a decision on Carver.

Hopson said later that the decision to delay closing Northside was out of “sensitivity” to neighborhoods where community meetings have been held in recent weeks. “While I didn’t necessarily anticipate this, I do think it’s consistent with our board being thoughtful,” he said.

Both Carver and Northside are on Tennessee’s list of priority schools, which are the state’s 5 percent of lowest-performing schools. Hopson recommended the closures last month as part of a cost-saving and efficiency plan to shutter schools that are under-enrolled and low-performing.

Administrators had estimated that the closings of Northside and Carver would save the district $1.7 million to help bridge the funding gap, but Hopson said the district should be able to make up the difference elsewhere.

As approved, the budget means the district will follow the advice of County Commissioner Eddie Jones, who last week invited the school board to bring all of their needs to the table.

“Before you cut anything, come ask for everything,” Jones said during a community meeting at Carver. “Come ask for what you need. As I’m learning, there’s money available. … It’s not can we do it, but will we do it?”

Jones has suggested that the full $32 million generated by the county’s wheel tax should go toward school operations instead of the current $16 million allocation for capital improvements. Shelby County Schools would get 78 percent of that total, which would be split with other districts in the county.

Jones’ remarks fly in the face of previous comments from other commissioners, who frequently have urged Shelby County Schools to close under-utilized schools.

The closure delays prompted Commissioner David Reaves, who is also a former school board member, to tweet during the meeting:

The 3 percent raises for teachers would apply only to teachers who receive evaluation scores of 3 to 5, but union representatives balked at that condition.

“The cost of living has had an impact on every teacher in the system, not certain ones,” said Keith Williams, executive director of Memphis-Shelby County Education Association.

Association president Patricia Scarborough added that the evaluation system is “flawed.”

It’s still unclear how many jobs will be lost under the approved budget.

The public got its first chance to review the full budget three days before approval when district leaders published it online Friday evening. The highlights were presented during school board budget review sessions during the last six weeks, but teacher raises were proposed less than a week before approval.

“This is the most distressing budget process I’ve seen,” Williams said. “It has been piecemeal out to the public.”

The $35 million spending gap is just $1 million less than the gap that the district started out with in its initial budget presentation to the board last month.

Though changes to benefits have not been finalized, the proposed plan that would begin Jan. 1 includes retirees increasing their cost share from 30 to 50 percent. Yvonne Acey, president-elect of the Shelby County Retired Teachers Association, said the impact on retirees with fixed incomes would be “tremendous.”

“Our incomes are low; our prescriptions are high,” she said. “We don’t want any changes.”

Administrators said the planned switch would save up to $10 million, which is included in the approved budget.