As soon as Caitlin Scull started her stopwatch, her classmate began texting.

“You want it to be real,” their teacher, Eric Gurule, told Scull and her partner. The student was texting with two hands — which few people do while driving.

The girl switched to just her right hand, holding her phone low near her waist as she pantomimed driving a car. “I’ll see you soon,” she texted her friend.

The watch stopped. 6.82 seconds.

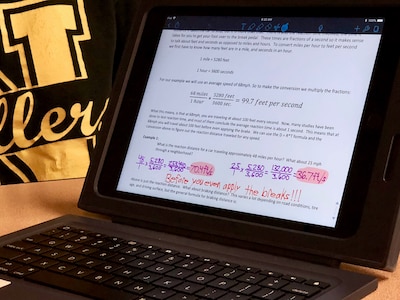

Turns out, a short text sent at 55 mph gets you 393 feet down the road — a little longer than the length of a football field.

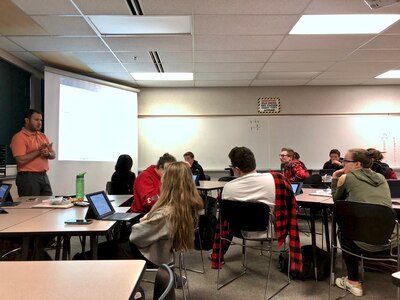

The calculations, based on numbers like braking and stopping time, were preceded by a talk in the Noblesville High School classroom from a local 24-year veteran police officer. He detailed to the class of about 20 students the risks of texting and driving, recounting nights he showed up at parents’ front doors to share the tragic news that their children had been killed.

It didn’t look like an Algebra 2 class. But that’s kind of the point.

Gurule teaches what his school calls “financial Algebra 2,” a direct substitute for the typical college-preparatory version that has vexed educators and students ever since Indiana made it part of its graduation requirements about a decade ago. The class meets the state’s Algebra 2 standards and is a good option for some students with learning challenges, those learning English, or those with no need or aptitude for higher-level math. Because it is more focused on real-world problem-solving, instead of the procedural steps of math computation, it can be easier for students to tackle the assignments and remember what to do.

Read: With new learning strategies, kids tackle higher-level math

Algebra 2 was added to the Core 40 diploma to prepare students for college in 2007. But now, more than 10 years later, educators and policymakers are grappling with how to balance challenging coursework that prepares kids for college with the reality that not every student will attend.

Indeed, across the nation, states have stepped up math requirements to include Algebra 2. But in several cases, they quickly walked those decisions back when they became stumbling blocks for students who aren’t able or don’t want to pursue advanced math. As Indiana and many other states direct more money and planning toward workforce readiness, it’s clear there’s a need for an alternative.

But Indiana officials have been loathe to change the Algebra 2 requirement — until now. Proposals in the Indiana General Assembly would allow the State Board of Education to rethink requiring students to complete the advanced course and consider alternatives. The state is already deep into the process of changing graduation requirements, including advancing proposals for a single state diploma and introducing a new “graduation pathways” system.

Read: 6 things you should know about Indiana’s new graduation rules

Noblesville presents one relevant case study. While many schools in the state offer math electives and alternative courses for students with special needs, there doesn’t seem to be many — if any — direct substitutes like what Noblesville High School has developed: a class that meets the state’s Algebra 2 standards but with a real-world rather than theoretical focus. As far as Gurule knows, his class is the only one.

“I couldn’t find a single class in Hamilton County that taught anything like this,” he said. “That was shocking to me, that there was not another sort of financial class or algebra class where they were incorporating algebra content with financial stuff.”

Chalkbeat reached out to Marion County districts, and of the ones that responded, none had a class like Gurule’s or a substitute for typical Algebra 2. But several superintendents were intrigued by the idea.

“As a former Business Math teacher, I think this is critical for our kids to understand the real world,” Paul Kaiser, superintendent of Beech Grove Schools, said in an email.

The class was born about three years ago when another Noblesville teacher, Andy Wilkins, noticed how much of a hurdle Algebra 2 had been for his students. He went to a conference and heard a session on an alternative finance-focused class and brought the idea back to his colleagues. He and a few coworkers got together to create the course and started with one class period. Last year, Gurule took it over. Now, Noblesville High School offers six class periods of financial Algebra 2 to about 170 students — about one-quarter of the students who’d be expected to Algebra 2.

“We sort of want the class to mimic life,” Gurule said. “A lot of our kids that were taking this class were kids that were going right from high school into the workforce or trade schools … we wanted them to have these sort of skills right when they got out into the real world.”

In the class, Gurule said students learn algebra by way of lessons on buying a home, paying student loans and other bills, and buying a car. They learn about making budgets, doing taxes, using credit cards, and planning for retirement. Gurule teaches them how the stock market works and how that factors into things like retirement accounts and savings.

Applying principles of Algebra 2 to such things isn’t difficult — loans accrue interest through exponential growth functions, and piecewise functions can be used to predict how much data you might use on your phone bill.

“They are not seeing just numbers,” said math department chair Laura Costa. “It all has context to it.”

And students aren’t missing much by way of curriculum. The class doesn’t cover some lessons on circles, hyperbolas and ellipses, but those topics are more relevant to precalculus, Gurule said. He focuses less on solving logarithmic functions and analyzing certain graphs, but his students still learn enough about those topics to meet state standards.

Gurule said he certainly has students who go on to college, but others go on to become veterinary technicians, hair stylists and welders. They find his class challenging, but they also appreciate that what they’re learning has a direct influence on their lives. And Gurule said he can teach it convincingly because he has struggled with finances in his own life.

“I was one of those people that made a lot of these financial mistakes,” he said. “A lot of this comes from real life. I think that every kid should be required to take something like this.”

The class also has also sparked a positive reaction from parents, Costa said. Students will go home and talk about what they’ve learned, and parents then reach back out to Gurule asking where this kind of class was when they were in high school.

But like many teachers, Gurule said his biggest struggle is getting students to be engaged who are not motivated in school. For the most part, Gurule said, students are engaged and enjoy his class.

“Some kids just don’t want to do anything, and that part is hard, especially in a class like this where you know that they need it,” Gurule said. “I know not every kid in there needs to know how to solve a quadratic equation, but I know every kid in there needs to know how a credit card works.”

Scull, a junior this year, said she struggled with math in years past. She was placed in the financial Algebra 2 class this year, which she likes because she can immediately see its relevance. When she graduates, she hopes to become a chef.

“I feel like I can understand it more and apply it to life more than, say, geometry or regular algebra,” Scull said. “I think it’d be cool if other schools offered this because that way, when young people get out of high school, they’ll hopefully know what to do. Would you rather live paycheck to paycheck, or would you rather budget and save and know what you’re doing?”