Several Indiana lawmakers, including two influential state representatives, are calling on Indianapolis Public Schools leaders to sell the Broad Ripple High School campus to Purdue Polytechnic High School.

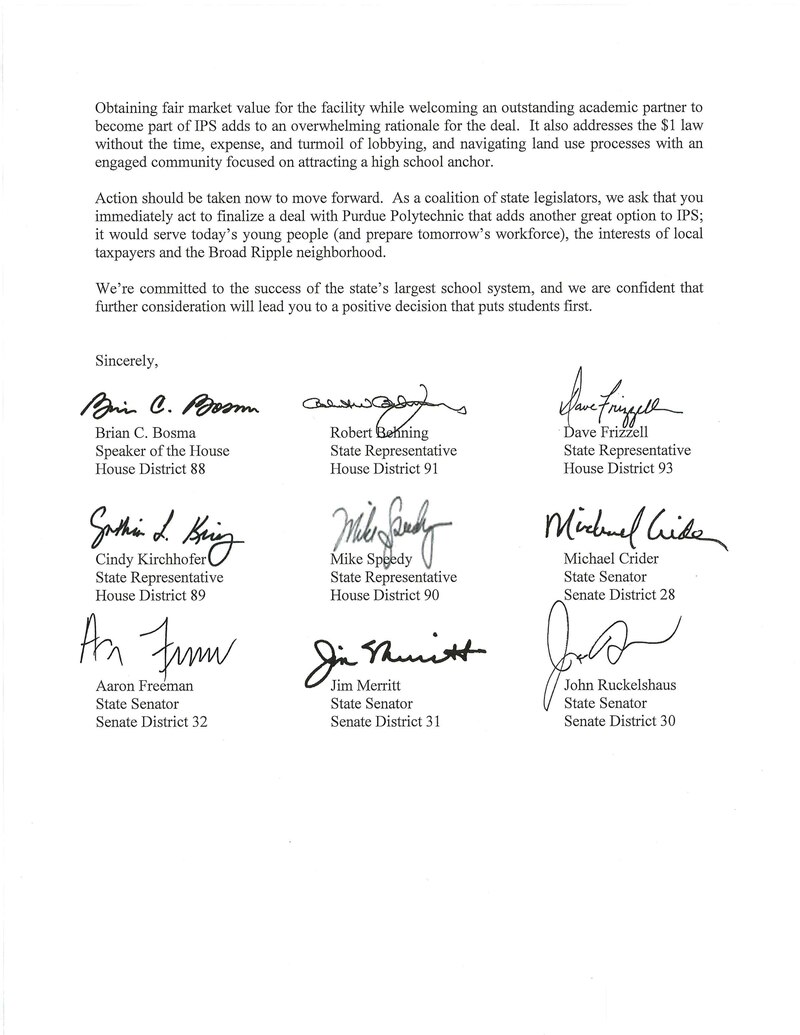

In a letter to Superintendent Lewis Ferebee and the Indianapolis Public Schools Board sent Tuesday, nine lawmakers urged the district to quickly accept a verbal offer from Purdue Polytechnic to lease the building for up to $8 million.

The letter is the latest volley in a sustained campaign from Broad Ripple residents and local leaders to pressure the district to lease or sell the desirable building to a charter school. The district is instead considering steps that could eventually allow them sell the large property on the open market.

But lawmakers said the offer from Purdue Polytechnic is more lucrative and indicated they wouldn’t support allowing the district to sell the property to other buyers.

The letter from lawmakers described selling the property to Purdue Polytechnic as a “unique opportunity to capitalize on an immediate revenue opportunity while adhering to the letter and spirit of state law.”

It’s an important development because it was signed by House Speaker Brian Bosma and chairman of the House Education Committee Bob Behning, two elected officials whose support would be essential to changing a law that requires the district to first offer the building to charter schools for $1. Both are Republicans from Indianapolis.

Last year, the district lobbied for the law to be modified, and Behning initially included language in a bill to do so. When charter schools, including Purdue Polytechnic, expressed interest in the building, he withdrew the proposal.

The district announced last month that it planned to use the Broad Ripple building for operations over the next year, which will allow it to avoid placing the building on the unused property registry that would eventually make it available to charter operators.

The plan to continue using the building inspired pointed criticism from lawmakers, who described the move in the letter as an excuse not to lease the property to a charter school. Lawmakers hinted that the plan will not help win support for changing the law.

“It certainly would not be a good faith start to any effort to persuade the General Assembly to reconsider the charter facility law,” the letter said.

The legislature goes back in session in January.

The Indianapolis Public Schools Board said in the statement that they appreciate the interest from lawmakers in the future of the building.

“We believe our constituents would not want us to circumvent a public process and bypass due diligence,” the statement continued. “We will continue to move with urgency recognizing our commitment to maximize resources for student needs and minimize burdens on taxpayers.”

Indianapolis Public Schools is currently gathering community perspectives on reusing the property and analyzing the market. The district is also planning an open process for soliciting proposals and bids for the property. The district’s proposal would stretch the sale process over about 15 months, culminating in a decision in September 2019. Purdue Polytechnic plans to open a second campus in fall 2019, and leaders are looking to nail down a location.