Soon every high school graduate in Michigan will be taught how to write a check, budget their money, invest their savings, and manage their credit.

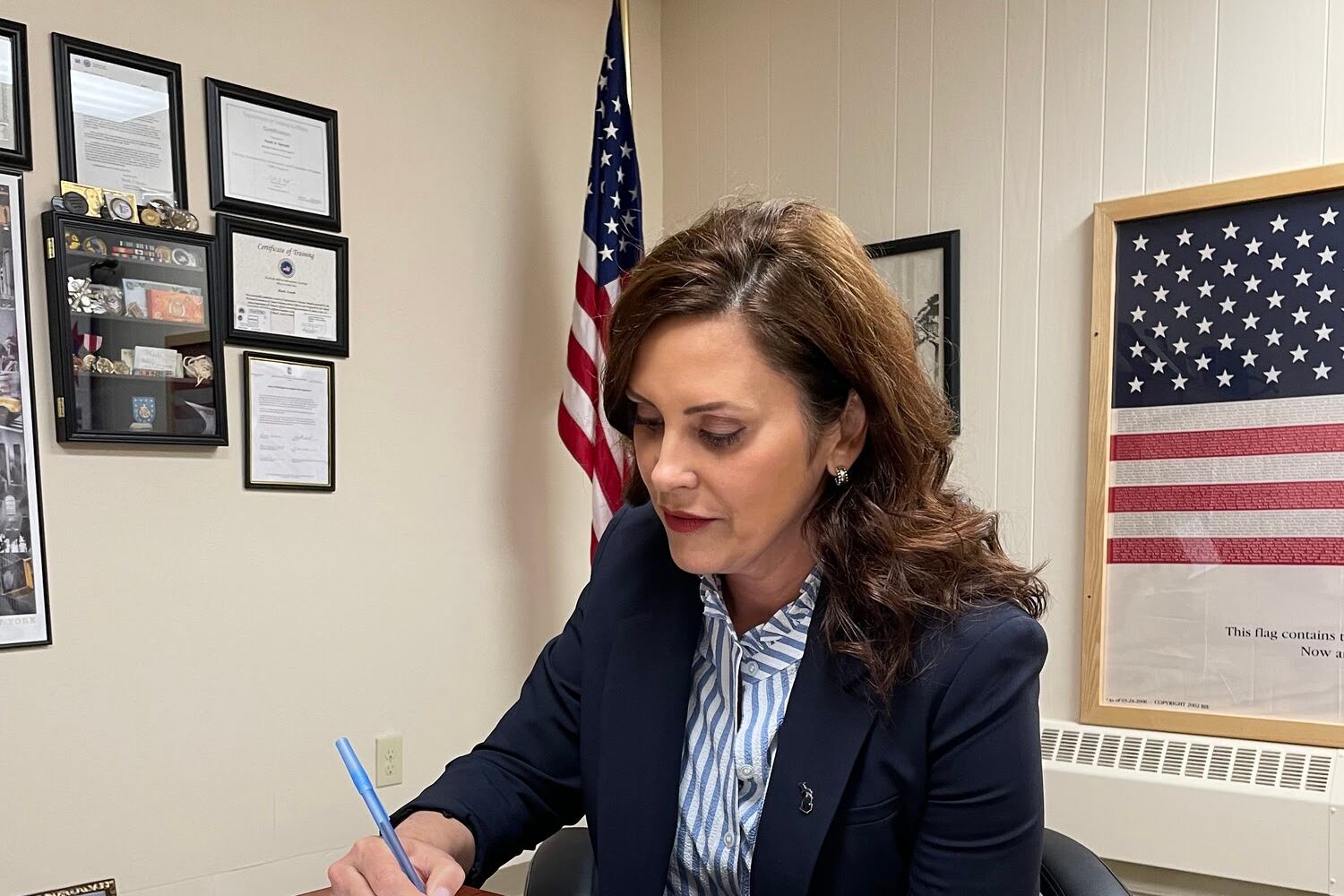

Gov. Gretchen Whitmer on Thursday signed a bill into law requiring students to take a half-credit personal finance class to graduate high school. The requirement begins with students entering eighth grade in the fall.

“As a mom, I want every kid who graduates in Michigan to enter the world with a diverse set of skills and knowledge, and that must include financial literacy,” Whitmer said in a written statement.

At the discretion of local school boards, the course could fulfill a half-credit in math, world language, or the arts. Currently, the Michigan Merit Curriculum requires four credits in math, two in a language other than English, and one in visual, performing, or applied arts.

The personal finance requirement also could be fulfilled through a career and technical education program that aligns with personal finance content standards. For example, CTE students studying finance already encounter coursework on personal financial goals, investment strategies, check writing, reconciling bank statements, and understanding credit and debit cards.

The Legislature also is considering a separate bill allowing computer programming to count for world language credit. Both measures have strong backing from business groups that say they’re interested in a more skilled workforce.

“As an industry, we see the value and impact knowledge of personal finance basics can have on a future borrower and consumer,” said Patty Corkery, president and CEO of Michigan Credit Union and Affiliates.

The curriculum requirement will prepare students for success in both careers and life, said Rick Baker, president and CEO of the Grand Rapids Chamber of Commerce.

“Too many young adults are unprepared when it comes to making major life decisions,” he said. “This legislation will give students the opportunity to learn and develop these skills early.”

Others, though, worry that the bills will reduce local control of curriculum and further crowd out humanities instruction in favor of more technical education.

The Michigan Association of Secondary School Principals said financial literacy is important. Still, the group lobbied against the law on the grounds that it doesn’t give districts enough flexibility to decide how to deliver instruction. For example, personal finance lessons could be incorporated into existing courses, lobbyist Bob Kefgen said.

State Superintendent Michael Rice said that he supports financial literacy instruction, but that it shouldn’t replace other course requirements that he considers important. Adding new requirements should be up to school districts, which can — and often do — add local graduation standards beyond the baseline requirements of the Michigan Merit Curriculum, he said.

“I think there’s value to taking a half-credit of personal finance,” Rice said. “I’m not convinced that we should have to choose between personal finance and one of these other courses. I think it can be both.”

The bill passed the state Senate last month on a 35-2 vote and the House last week on a 94-13 vote.

Personal finance education means Michigan high school graduates “won’t get caught off guard by the financial decisions that await them,” said the bill’s sponsor, Republican state Rep. Diana Farrington of Utica.

Sen. Dayna Polehanki, a Democrat from Livonia, supported the measure.

Polehanki said that when she was a high school English teacher, she would ask her seniors at the end of the school year what life skills they wanted to know about. They most often asked about two things, she said: how to change a tire and how to write a check. Often, they also asked about credit scores, mortgages, and the difference between credit and debit cards.

“These kids are begging for these types of skills,” Polehanki said.

Tracie Mauriello covers state education policy for Chalkbeat Detroit and Bridge Michigan. Reach her at tmauriello@chalkbeat.org.