Voters overwhelmingly approved the renewal of a tax that will send about $90 million per year to schools in Wayne County beginning in 2022, continuing a program that has already allowed districts to reduce class sizes and provide extra help to struggling students.

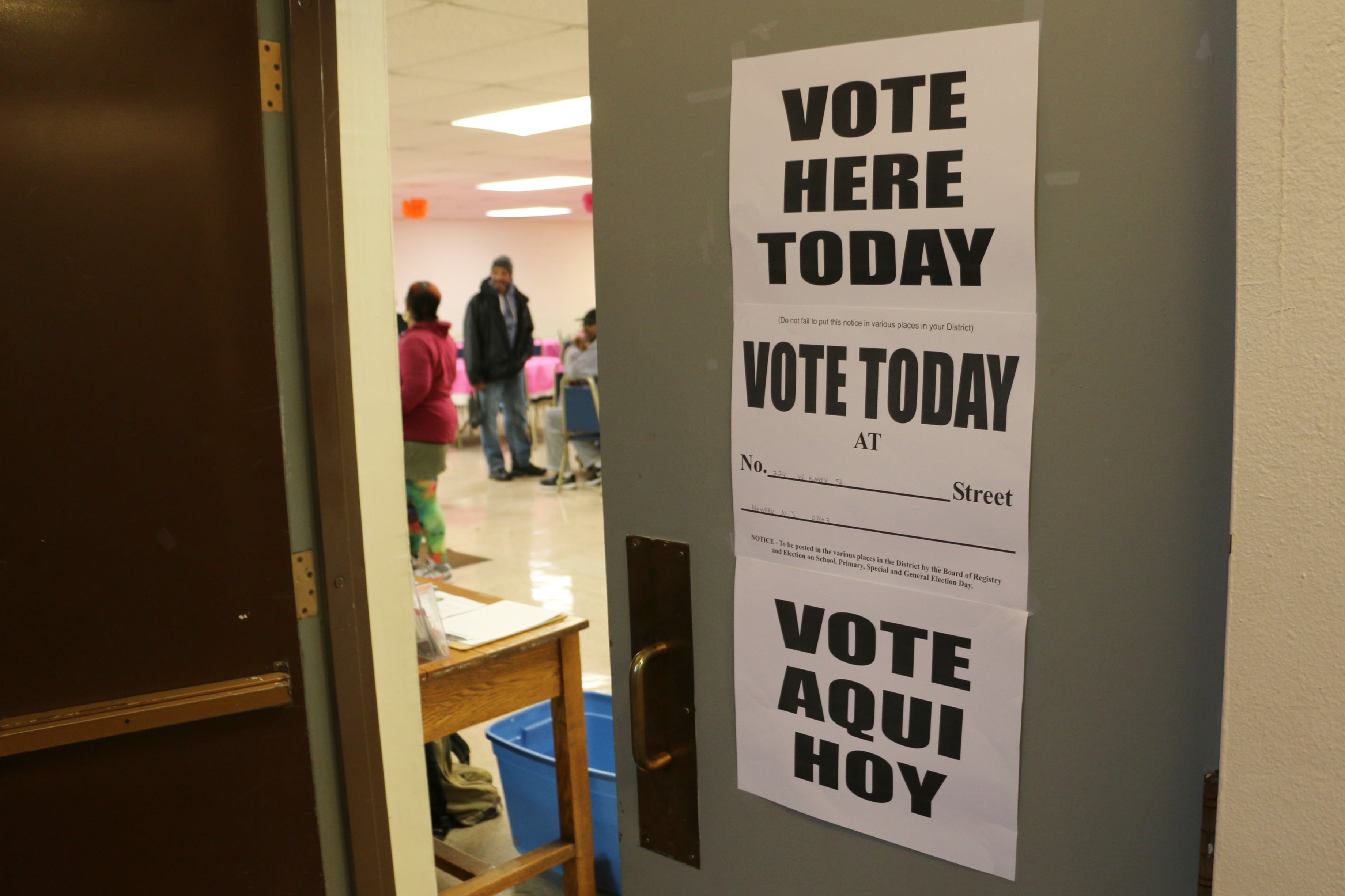

With 100% of precincts reporting at 10:29 a.m. Thursday in the state’s most populous county, 68% of voters supported the millage.

There was no apparent organized opposition to the renewal, which won’t increase taxes for Wayne County homeowners. The average homeowner will continue paying $8 monthly, or about $96 annually, for the 2-mill millage.

The enhancement millage, first approved in 2016 with 54% of the vote, has generated about $80 million annually for schools. It expires in 2021.

Charter schools, public schools that are typically overseen by a public university instead of an elected school board, had previously been barred from receiving the funds. They will be able to get a piece of the millage revenue thanks to a Michigan law enacted in 2018.

Superintendents across the county said the millage has already allowed them to reduce class sizes, purchase technology, provide teacher training, and increase salaries for teachers. Nikolai Vitti, superintendent of the Detroit Public Schools Community District, said there would have been a “substantial hole” in his budget if the millage failed.

The tax will generate an estimated $90 million in 2022 and will continue for six years. The money will be divided based on enrollment between the county’s 33 school districts as well as dozens of charter schools. The tax will provide an estimated $300 per student.