Update May 3: Here are the election results for the IPS, Warren Township and Speedway Schools school tax referendums.

Voters in three school districts in Marion County will decide if their schools will get property tax funds through ballot questions on the May primary election ballot.

If approved, Indianapolis Public Schools will use the funds for construction and renovation projects, while the Metropolitan School District of Warren Township and the School Town of Speedway will use the funds for operating expenses.

For Speedway schools, the referendum would renew an existing property tax, and in Warren, the ballot question amount replaces the rate from 2018. For IPS, the capital referendum is new.

Read more about each referendum here:

Indianapolis Public Schools seeks funding for building upgrades

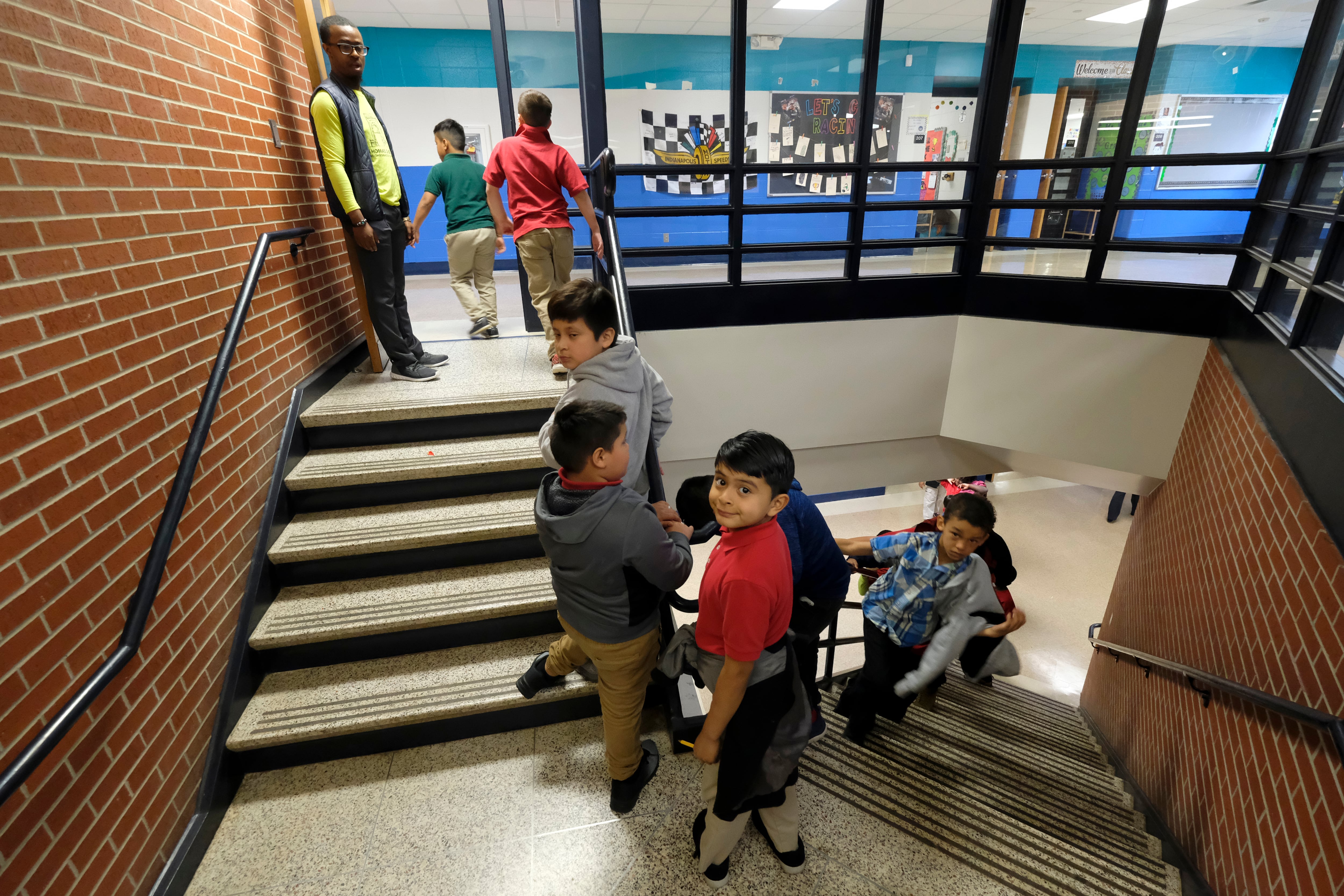

IPS will ask voters for $410 million to fund athletic fields, new windows, fresh sidewalks, and a new 650-student elementary school. Twenty-three schools will get improvements, which vary based on the building’s need.

This referendum is in addition to the district’s 2018 capital referendum which was for safety and security upgrades. The 2023 ballot question is part of the district’s Rebuilding Stronger reorganization, a sweeping overhaul that aims to address declining enrollment, looming financial instability, and educational inequities for students of color. In January, the school board delayed a vote on a separate referendum for operating expenses that would pay for Rebuilding Stronger’s academic programming changes.

The referendum is projected to increase property tax rates by up to about 21 cents per $100 of assessed value.

Speedway schools seek tax renewal for staffing

The School Town of Speedway is asking voters to renew an existing property tax for operating expenses that would help the small district continue funding its staff, including teachers, paraprofessionals, and custodians.

The referendum would renew the previous tax rate of 59 cents per $100 of assessed value, which voters passed in 2010 and again in 2016.

Warren Township seeks tax increase

The Metropolitan School District of Warren Township is asking voters for an $88 million property tax increase over eight years, in part to continue efforts funded with federal COVID stimulus dollars, which the state says must be spent by the end of 2024.

The money would fund the district’s police department, school counselors, bus drivers, support staff, and family engagement liaisons, as well as teacher training programs.

The ballot question would replace the rate voters approved in a 2018 referendum for operating expenses by increasing it from 21 cents per $100 of assessed property value to 30 cents.

When and where to vote

Early voting starts April 4 at the Indianapolis City-County Building. Additional early voting sites open April 22.

On Election Day, May 2, polls are open 6 a.m to 6 p.m., and Marion County residents can vote at any of the county’s voting centers.

To find voting center locations for early voting and Election Day, apply for an absentee ballot and to see a sample ballot, visit vote.indy.gov.

Amelia Pak-Harvey covers Indianapolis and Marion County schools for Chalkbeat Indiana. Contact Amelia at apak-harvey@chalkbeat.org.

MJ Slaby oversees Chalkbeat Indiana’s coverage as bureau chief and covers higher education. Contact MJ at mslaby@chalkbeat.org.