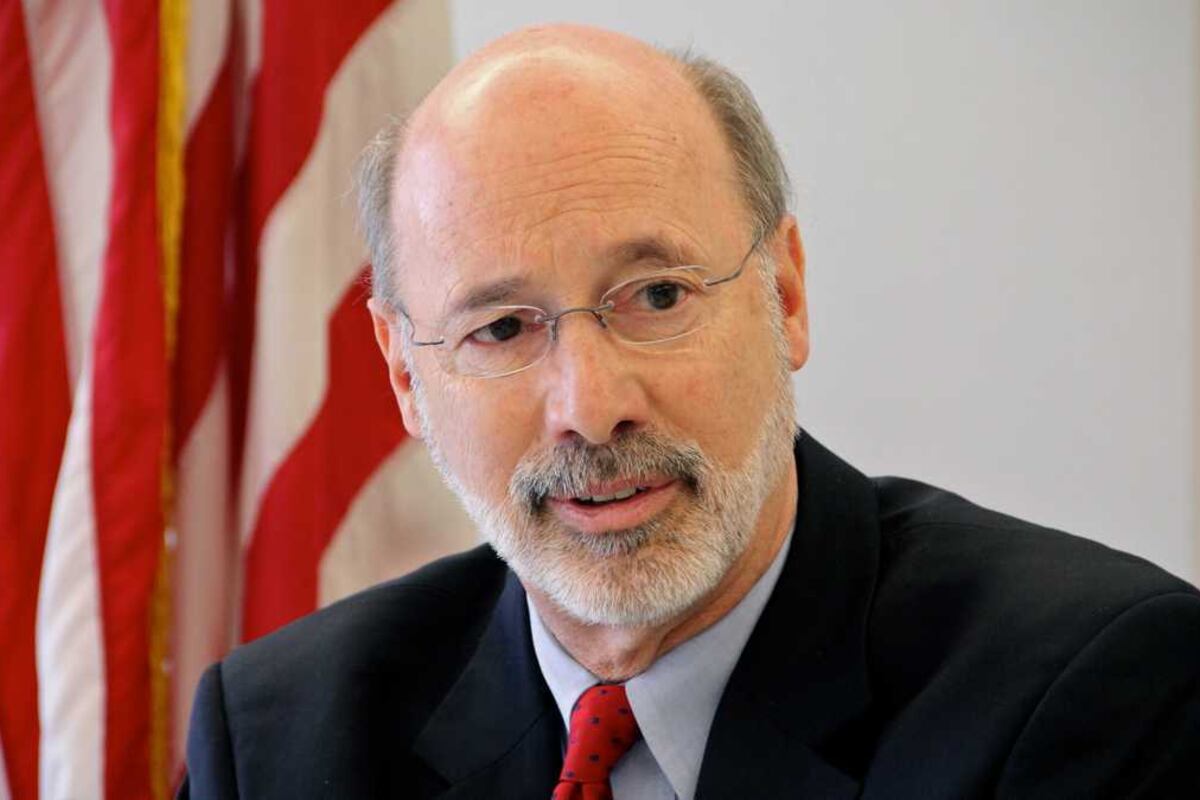

Gov. Tom Wolf proposed Wednesday a groundbreaking state budget that would significantly boost state education aid for public schools and redistribute the funds in a way that is more aligned to districts’ enrollment and needs.

The reallocation would largely benefit urban areas like Philadelphia. If Wolf’s plan is adopted, the state’s largest district would receive more than $300 million in additional funds next year.

Wolf, who is approaching the end of his second term, wants to hike the income tax rate on higher earners — over $84,000 for a family of four — to pay for the increases. This would raise $3 billion, about half of which would go to education.

“Today, I’m proposing we do things differently,” he said in a 20-minute, virtual budget address.

He said changing the way the state allocates aid will address longstanding and damaging inequitable and inadequate education funding in the state.

“Far too many parents across the commonwealth...felt like the opportunities available to their kids would be determined less by their talent and more by their zip code,” he said.

Democrats and education advocates praised the governor’s action as needed and long overdue. “We’ve been waiting for this moment,” said state Sen. Vincent Hughes, a Philadelphia Democrat whose legislative district includes some wealthy districts adjacent to the city. “This is something we have been fighting to achieve for decades...to deal with a significant level of inequity in education funding. The governor has thrown out a challenge.”

Republican legislative leaders objected to the proposal, particularly the proposed tax hike.

“This is a massive tax increase on Pennsylvanians who are already suffering,” said state Rep. Kerry Benninghoff, the House majority leader. “What we heard from the governor is that the administration’s idea is more taxation in order to move Pennsylvania ahead and return us to normal. We disagree with that.”

Wolf’s proposal would boost the income tax rate from 3.04% to 4.49% for high earners while expanding a tax forgiveness program for those with lower incomes that, for some, would eliminate taxes altogether, he said.

The state’s income tax rate is the lowest in the country among the 41 states that have an income tax, and it hasn’t been raised since 2003. It is a flat tax because of a “uniformity” clause in the state constitution.

Wolf proposed the expanded tax forgiveness program because he is unable to put forward a graduated income tax without a constitutional amendment. However, Republicans said they were prepared to argue that this also violates the constitution.

An analysis by the liberal-leaning Pennsylvania Budget and Policy Center found that, under Wolf’s tax proposal, more than 40% of Pennsylvania families would see their taxes go down and the taxes for another 27% would stay the same. Only the most well-off third of Pennsylvanians would pay more, the analysis found.

In overall education spending, Pennsylvania also has one of the lowest state contributions compared to the share paid by school districts — less than 40% compared to a national average of about half. This has resulted in high property tax burdens in many areas and one of the widest spending gaps in the country between wealthy and poor districts.

Philadelphia superintendent William Hite called Wolf’s proposal “bold,” saying it would have a significant impact on the district’s ability to invest in classrooms and infrastructure. Board president Joyce Wilkerson said “it takes a big step toward ensuring that education dollars are distributed equitably across Pennsylvania.”

Pennsylvania’s system for allocating most of the aid to school districts has long been criticized as unfair and inadequate. For 30 years, it has been disconnected from a district’s demographic and enrollment trends and students’ level of need.

In 2014, the legislature adopted a funding formula that would have corrected that by giving extra weight per pupil to factors such as poverty, English learner status, and special education. It also considered concentration of poverty and a district’s taxing capacity.

But lawmakers only applied it to new allocations, not the entire pot, while inserting a “hold harmless” clause that assured no district could get less than it got the year before, even if its enrollment dipped. More than 300 of the state’s 500 districts fall into that category, mostly small and rural, although Pittsburgh is also among them.

A report by the advocacy group Public Citizens for Children and Youth released last week found that this “hold harmless” provision benefited shrinking districts at the expense of those with stable or growing enrollment. Since 1991 — the last time aid was calculated on a per pupil basis — $590 million has been paid to districts for students they no longer educate, while growing districts have received no funding for more than 200,000 additional students, the report found.

Of the additional $1.5 billion proposed for K-12 education in Wolf’s proposal, more than $1 billion would go to the “hold harmless” districts to cushion the impact of the change in the allocation formula. The rest will go toward a $200 million increase in the basic education subsidies to school districts, and $200 million to special education.

A December report found that school districts over the past decade have been forced to shoulder an increasing burden of special education costs.

“The governor’s historic education budget proposal could be the start of a better future for the commonwealth,” said Deborah Gordon Klehr, executive director of the Education Law Center, which advocates for equity issues in schools including for special education students.

The Education Law Center is one of two groups representing plaintiffs in a longstanding school funding lawsuit expected to go to trial this year that could impact the political calculus.

In his budget, Wolf also wants to reform charter school funding by paying less to cyber charters, which have consistently low academic performance, and changing the way charters are reimbursed for special education students. A growing number of districts in the state have complained that reimbursements to charters for students who attend them are eating into their already stretched budgets.

“We support the Governor’s call for a charter school law that allows the highest quality charter schools to thrive, prevents financial mismanagement and provides appropriate levels of funding to both brick and mortar and cyber charter schools,” said Frank Gallagher, superintendent of the Souderton Area School District, in a statement on behalf of a coalition of districts organized to advocate for charter funding reform.

Prior efforts to do this, however, have failed. The charter law has not been significantly altered since 1997.

The head of the state’s largest charter school lobbying group called the proposal “callously wrong.”

In his first year in office, Wolf tried a similar bold overhaul of the state’s income tax and its education funding formula. But it caused a nine-month budget impasse with the Republican-controlled legislature and no major change.

The state must adopt a budget by the end of June.