Some of the biggest and best-known development projects in Philadelphia are powered in part by a state tax break called the Keystone Opportunity Zone.

The Navy Yard in South Philly, Schuylkill Yards in University City, and the massive new Bellwether District at the former PES refinery are all part of the program, which was created in the late 1990s to spur redevelopment of post-industrial buildings and properties around Pennsylvania.

What does the program do? In short, KOZs eliminate almost all state and local taxes for the owners of the designated parcels and businesses in the zones.

State officials have described it as “one of the nation’s boldest and most innovative economic and community development programs.” Supporters say it’s an essential tool for clearing blight, reinvigorating dormant land that might otherwise be too expensive to redevelop, and inducing employers to come to or remain in Pennsylvania rather than being enticed to other states with their own generous incentive programs.

How well it accomplishes those goals, and at what cost, is unclear.

While the program is overseen by the state Department of Community and Economic Development, no one keeps track of exactly how many new jobs it creates, or how much lost tax revenue the KOZs cost each year.

With few obligations attached to the designation, many property owners receive tax abatements for a decade or longer while their sites remain partly or wholly undeveloped.

Initially just an effort to revive 12 properties across the commonwealth, the program has morphed into a huge program covering more than 2,000 parcels, including some that were already being developed or are in economically booming neighborhoods.

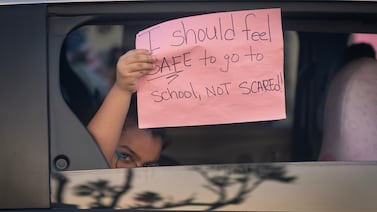

There are currently 287 zones in Philadelphia, according to the city Department of Commerce. Their use as a general-purpose economic development incentive has led to battles over designations that seemed to favor one politically connected developer over another — and some have criticized it for threatening to sap the school district of badly needed tax revenues.

From a dozen to thousands of tax breaks

Inspired by a similar program in Michigan, the Pennsylvania Legislature created the Keystone Opportunity Zone program in 1998, under Gov. Tom Ridge. The initial legislation created 12 areas, before subsequent legislation permitted many more.

The property owners get a real estate tax abatement, and businesses located on KOZs don’t have to pay most state and local taxes for the period of designation, which is usually between 10 and 15 years and can be renewed. (In Philadelphia, however, they do have to pay the wage tax for employees.)

Each designation area must be approved by the state — and by local entities that stand to lose tax revenue. In Philadelphia, that’s City Council and the Board of Education.

Over time, the rules for KOZs were eased.

For example, the original law required a company located in a KOZ to either boost employment by 20% or invest at least 10% of its previous year revenue to receive the tax abatements. After the turn of the millennium, that rule was changed. To get the tax break, a tenant firm had only to sign a lease covering the duration of the zone and spend at least 5% of the previous year’s revenue on rent.

State: It’s impossible to collect data to assess the program cost

The KOZ program is often criticized for poor transparency and accountability, and a lack of clarity about how to measure its success. The state initially hired the Allegheny Institute for Public Policy in Pittsburgh to monitor the program but ended the arrangement in 2002.

“They weren’t really interested in whether it did any good, and that’s a shame,” the institute’s president Jake Haulk later told the Inquirer.

In 2009, a state legislative committee tried to review the program, but ended up without a firm conclusion — saying that the Department of Community and Economic Development didn’t provide reliable data.

The DCED claimed the program had created 63,966 new jobs and retained over 48,158 jobs, but reviewers concluded the data was “substantially overstated and not supportable.” The agency didn’t calculate the program’s cost in lost taxes, and declined to release the value of tax credits received by a sample of KOZ participants.

The committee report also noted that, 10 years into the program, about 70% of approved KOZ acreage statewide remained undeveloped and many participants “received KOZ benefits without having to create jobs or generate capital investment.”

Philadelphia had 2,755 KOZ acres at the time, of which 53% were undeveloped.

State officials said it would be expensive and difficult to collect tax data for all of the state’s hundreds of KOZs, and impossible to disentangle the program’s job-creation and development effects from those of other incentive programs.

City: Yes, but we can estimate — and it could take 50 years to pay off

One of the few substantial efforts to analyze KOZs — at least those in Philadelphia — was conducted in 2014 by then-City Controller Alan Butkovitz.

He concluded that the program created a major tax burden for a meager return, WHYY’s PlanPhilly reported. It had so far cost the city and school district more than $380 million in abated business and property taxes, he found, while netting $132 million in wage taxes from 617 participating businesses.

More than 70% of that came from businesses that were already paying wage taxes before, rather than new enterprises.

By analyzing tax data, Butkovitz calculated the KOZs had created 3,700 jobs, with the city waiving more than $100,000 in tax revenue for each one. At an average salary of $50,000 per job, it would take more than 50 years of wage taxes for those new jobs to pay for themselves.

Like the state legislative committee, the controller concluded that “the records necessary to provide adequate oversight of the KOZ program largely do not exist.”

IRS rules barred the city from releasing participants’ tax bills, and the only direct data on job creation was self-reported by the businesses.

The city’s Department of Commerce also commissioned a report in 2019 on the program’s costs and benefits.

From 2008 and 2017 Philadelphia had foregone between $40 million and $125 million each year in two types of business taxes, the BIRT and NPT, or $645 million total in 2019 dollars, the report said. A breakdown of the 2016 data showed that financial services firms received 70% of the BIRT abatements that year.

When other types of taxes were included, the total value of abatements over those 10 years was $627 million, while city revenues from wage, sales and other taxes from the KOZ businesses was $462 million, the analysis found. Looking over a 15-year period, the report projected $676 million in revenues, or $49 million more than the KOZs cost, and argued that meant the city would see a 10% return on its investment.

The larger businesses in KOZs together reported employing the equivalent of 9,025 full-time employees, the report said. That figure was not independently verified, and the report did not say how many of those were newly created jobs.

The study concluded that KOZ status had some influence on where businesses decided to locate, but the financial services firms that received most of the benefit created few jobs and there was no mechanism for ensuring participants delivered broader public benefits beyond developing the parcels.

It recommended approving KOZs only where new development would not occur anyway; providing prospective tenants with clearer estimates of the benefits of locating in a KOZ; changing laws to allow cities to offered tailored payment in lieu of taxes (PILOT) plans to KOZ businesses; and limiting use of the program by companies that produce few jobs. The city has since established PILOTs for some of its KOZs to compensate for the loss of school district revenues.

What defines ‘blight’ when applying for a tax break?

Around 2004, Gov. Ed Rendell proposed designating proposed office tower projects in Philadelphia as KOZs, provoking a stormy debate.

Critics argued using the designation for downtown office towers would benefit politically connected developers and wealthy law firms, favor new buildings over old ones, and continue to move jobs around rather than boosting overall employment.

At the time, there were at least 112 existing KOZ properties in Philadelphia exempted from real estate taxes, per the Inquirer. Many companies had relocated to the zones from elsewhere in Philly, not from outside the city. Their combined assessed value was $38 million, which would translate to $3.2 million in foregone annual property taxes. The city’s total property tax collections that year were close to $900 million.

Only the future Cira Centre next to 30th Street Station ended up getting the designation that year.

Comcast’s planned tower at 17th and JFK Boulevard was denied KOZ status, but it received a reported $43 million in other state subsidies, and was built anyway.

In 2011, after Philadelphia’s first set of KOZs expired, an Inquirer analysis found that most of the job growth the state attributed to them came from just one site — a Marshall’s distribution center near Philadelphia Northeast Airport that employed 1,500 people. With the KOZs’ expiration, the tenant businesses would start paying $6.3 million in new property taxes.

By 2016, when there were close to 150 KOZ properties in Philadelphia, City Council passed a bill to add 80 more.

Critics noted that some of the new zones were already slated for redevelopment while others were in University City and other economically booming areas where tax stimulus was arguably not needed.

Council also approved then-Councilmember Helen Gym’s bill requiring KOZs to report how much subsidy they receive, the number of jobs they create and other information. Gym said the goal was to ensure the KOZs were creating jobs rather than just shifting them from place to place.

Lobbying reverses 382 board denials

Proposals to create or extend KOZs continue to generate pushback when they come before the Philadelphia school board.

In 2018, another 68 parcels in Philly were added despite concerns that many were not blighted. The Frankford Arsenal Complex in Northeast Philly, for example, was already developed and had recently sold for $6 million.

In an effort to protect education funding, the owners of those particular properties agreed to make payments in lieu of taxes, or PILOTs, that were 10% higher than the usual amount of property taxes reserved for the schools.

In 2020, the school board initially rejected a 10-year extension for part of the former South Philly refinery, where Hilco Redevelopment Partners is building the Bellwether District. After Hilco vowed to provide jobs for graduates of city schools, a dissenting board member changed her vote, and the extension was approved.

Another controversy arose in 2020 when a wealthy law firm, Dechert LLP, sought a second round of KOZ tax breaks by moving from the Cira Centre, whose KOZ status had expired, into a planned building at Brandywine Realty Trust’s Schuylkill Yards office tower complex near 30th Street Station.

The state DCED argued that would defeat the law’s purpose of revitalizing distressed areas, but a court ruled the KOZ statute contained no restriction on zone-hopping and allowed the move to proceed.

This past August, the school board approved extensions of several KOZs but initially rejected one for the Arsenal property in Tacony. After lobbying by the developer and a visit to the site by some board members, the board again reversed itself and approved the extension.

This article has been updated with details from the 2019 city report.