Wayne County voters will decide the fate of a special school fund that for four years has generated enough cash to allow districts to reduce class sizes, purchase technology, provide more help to struggling students, and improve buildings.

The enhancement millage, first approved in 2016, has generated about $80 million annually that has been divided among the county’s 33 school districts. If voters renew the 2-mill millage on Nov. 3, it will generate an estimated $90 million annually beginning in 2022.

And, thanks to a Michigan law enacted in 2018, charter schools for the first time would be able to get a piece of the additional revenue. They previously had not been allowed because state law barred charter schools — which don’t generate tax revenue — from sharing in the revenue.

Renewal won’t represent a tax increase for Wayne County homeowners. But it does mean the average homeowner will continue paying $8 monthly, or about $96 annually, for the tax. There has been no noticeable organized opposition to the renewal.

So far, the additional money “has been a game changer for our local school districts,” said Randy Liepa, superintendent of the Wayne Regional Educational Service Agency. Liepa said a renewal means “we can ensure our schools and neighborhoods stay strong.”

His agency is one of 56 intermediate school districts in Michigan that provide a range of services to local districts, including special education and in many cases career and technical education.

The money from the millage flows through the agency, which collects and then distributes the money to local districts. The Wayne RESA does not receive any of the revenue.

Before the fund was approved, the Detroit school district had one computer device for every student. Now, there is one for every student to use in school, Superintendent Nikolai Vitti said. The district has received about $15 million annually from the fund. A separate philanthropic effort has provided tablets for district students to use at home.

The district has also used some of the money from the millage to provide pay boosts for teachers and to lower class sizes, Vitti said.

If the tax isn’t renewed, “it’s going to create a substantial hole in the budget that will only be filled if we cut programs and no one wants to see that kind of impact on children,” Vitti said.

Losing the funds, would also mean the DPSCD would have to scale back on reform commitments that were already a part of the operating budget such as raising teacher salaries and lowering class size.

To maintain transparency on how the tax dollars are spent, an independent audit of all spending will continue to be tracked on a public website to ensure accountability, according to Wayne RESA officials.

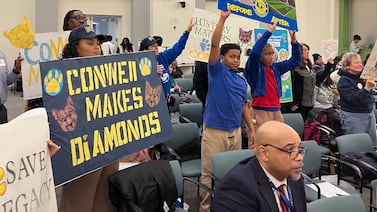

Since the proposal will sit at the end of a long and lengthy ballot, Liepa said mailings and plenty of grassroots efforts from local school district organizations will help spread the word about the importance of renewing the millage.

Monica Merritt, superintendent of Plymouth-Canton Community Schools said $1.5 million from the $6 million enhancement the district received annually helped reduce classroom size by one student across all grade levels. Merritt said just one less child in a classroom can make a big difference for teachers.

Students in the Plymouth-Canton Community also benefited from software and technology updates and professional development programs for staff members.

For this current school year, the revenue helped some school districts with the pandemic-related switch to online learning.

“The millage has also provided critical resources, otherwise not available, to help ensure a safe return to school in light of the COVID-19 pandemic,” Merritt said.

Cortnie Squirewell, school board director at Detroit Enterprise Academy, said money from the millage would help the school increase technology resources and help expand transportation once the revenue begins flowing to charter schools in 2022.

“There are a lot of free services that are not available to charter schools students. The additional funding can help offset some of the costs for our enrichment programs,” said Squirewell, who is also the executive director of innovation and stakeholder engagement for the Boys & Girls Club of Southeastern Michigan.

“More funding for our students doesn’t only create better opportunities but increases economic mobility for families so that they can reach the next level and excel.”