In the final days of the legislative session, state lawmakers are considering a bill asking voters to approve a nicotine tax that would help offset state education cuts, including for rural schools, and expand Colorado’s public preschool program starting in fall 2023.

If passed in the legislature and by voters in November, the measure would help achieve one of Gov. Jared Polis’ signature goals: providing preschool to 4-year-olds statewide at no cost to parents.

The bill passed the House Friday and received initial approval in the Senate late Saturday. It still needs a final vote on Monday. A similar proposal died last year in the Senate, but this year’s coronavirus-induced budget crisis made the latest version and its promise of additional state revenue more appealing to some lawmakers.

The bill would let voters decide whether to increase cigarette taxes by $1.10 a pack initially, with the amount rising to $1.80 per pack after seven years. It would also create a new tax on vaping products.

Bill Jaeger, vice president for early childhood and policy initiatives for the Colorado Children’s Campaign, said opposition from the tobacco industry has softened since last year and that an amendment to earmark money for rural schools may help get the bill over the finish line. In addition to providing school and preschool funding, the nicotine tax would raise new money for tobacco education, health insurance for low-income residents, and cancer prevention.

“It’s such a triple win for health, early childhood, and the state budget,” he said.

Prior to the pandemic, advocates planned to collect thousands of signatures from state residents to get a nicotine tax measure on the ballot. But that citizen-initiated measure was drafted in a pre-coronavirus world and couldn’t be adjusted to help with the financial fallout from the disease, Jaeger said. Plus, in-person signature gathering grew more difficult, and online signature gathering — while now allowed — would be expensive. That’s why backers changed course and sought to get the bill on the November ballot through the legislature.

If approved by voters, the current nicotine tax proposal would eventually pay for statewide half-day preschool for all 4-year-olds. However, it would take until 2023, about a year longer than the timeline envisioned under the citizen-initiated proposal. That’s because the additional revenue collected in the first two and a half years would be spent helping backfill the state budget.

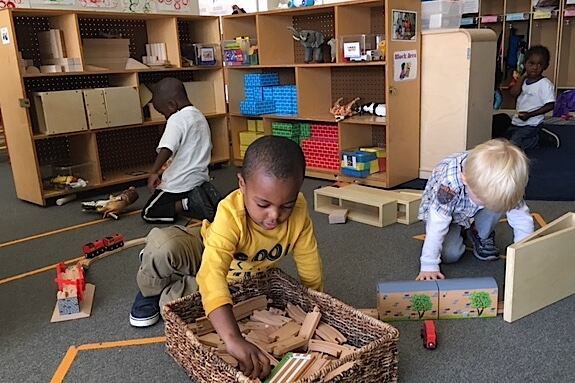

In 2019-20, about 23,500 children — mostly 4-year-olds and some 3-year-olds — were enrolled in Colorado’s public preschool program, mostly in half-day classrooms. The program serves children from low-income families and those who have other risk factors, such as language or social delays.

A new nicotine tax would dramatically expand the number of 4-year-olds with access to the program. The bill would also allocate additional money collected above the amount needed for universal preschool to provide extra services to preschoolers with the highest needs.