Sign up for Chalkbeat Colorado’s free daily newsletter to get the latest reporting from us, plus curated news from other Colorado outlets, delivered to your inbox.

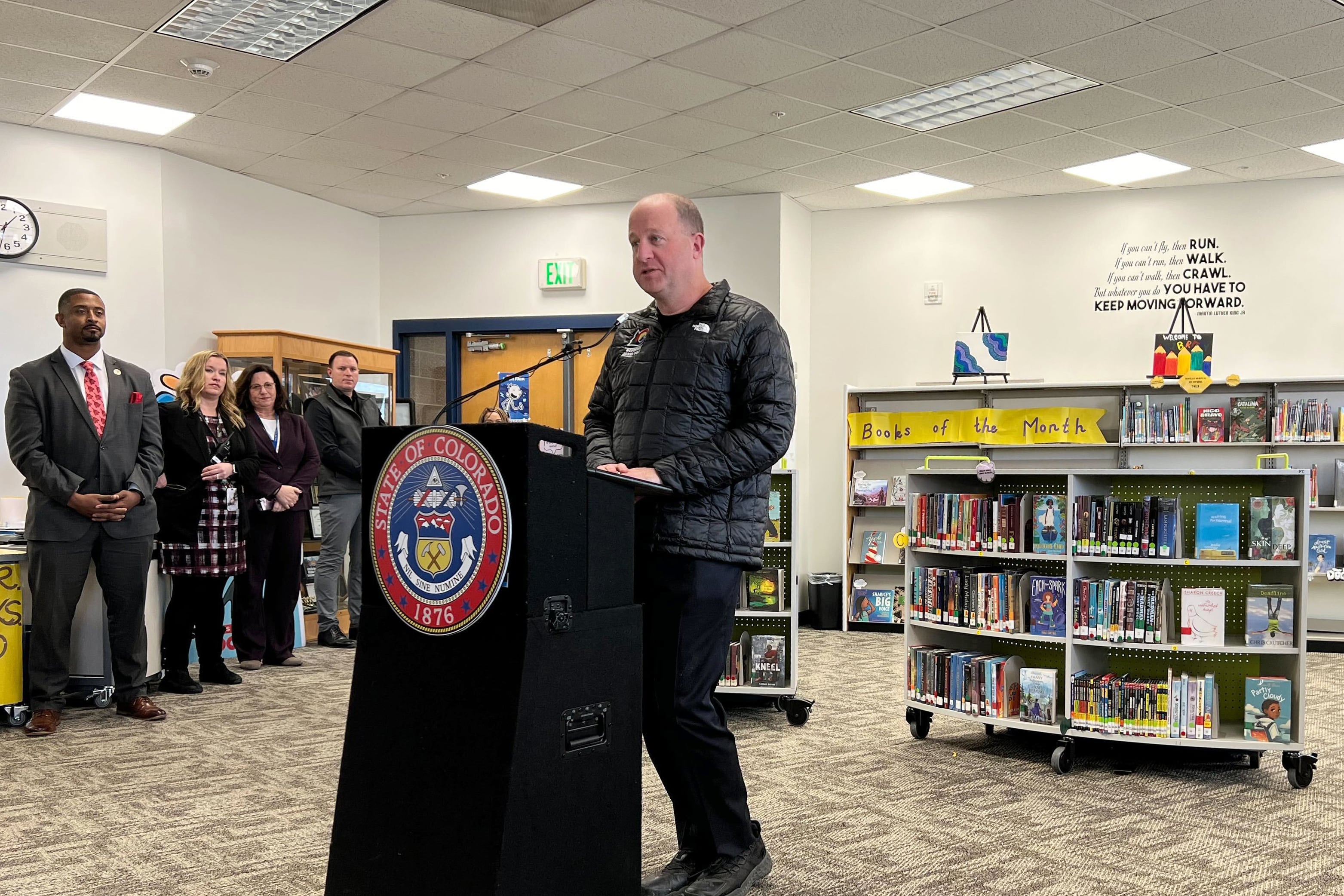

Gov. Jared Polis plans to opt Colorado into a federal tax-credit scholarship program, opening the door to private school choice in a Democratic state where lawmakers and voters have rejected previous proposals.

Conservatives, children’s advocates, and supporters of school choice praised the decision for its possibility to raise money for all students’ education. Meanwhile, a coalition of public school advocates sent a letter to Polis this week asking him to reconsider.

The voucher-like program, part of President Donald Trump’s “big, beautiful” budget bill, has the potential to generate billions of dollars for private school tuition and other educational expenses, such as tutoring, but governors have to decide whether to participate.

Polis appears to be the second Democratic governor to announce his intention to join. North Carolina Gov. Josh Stein did so in August under pressure from state Republican lawmakers who have dramatically expanded the state’s voucher system. Polis also is the second governor to opt in from a state where voters rejected a school choice measure at the ballot. Nebraska Gov. Jim Pillen, a Republican, signed an order in September declaring that his state would participate, setting the stage for Nebraska’s first private school choice program after voters there overturned voucher legislation in 2024.

School choice supporters had hoped the federal program would expand educational opportunities in states where politics made it difficult or impossible to pass voucher legislation. Polis, meanwhile, said he saw other potential benefits.

Polis spokesperson Shelby Wieman said in a statement Friday that the governor would not have voted for the budget bill, but he is not interested in leaving hundreds of millions in federal money on the table that could provide additional funding for after-school programming, summer school, scholarships, and academic tutoring.

“This tax credit creates an immense opportunity for Coloradans to support students in our state, but only if we opt in,” she said. “He welcomes the opportunity to work with school districts and other education stakeholders to help ensure this credit can benefit the greatest number of students across our state with evidence-based programs that supplement school days. He encourages the administration to ensure these tax credits lead to improved student outcomes.”

The tax-credit program allows taxpayers to reduce their tax liability if they donate to eligible scholarship-granting organizations, which then pay for students’ educational expenses.

The law allows donations to benefit public and private school students alike, but how feasible it might be to harness donations for public school students will depend in part on rules that the Treasury Department has yet to issue.

The Colorado Sun first reported that Polis plans to opt Colorado into the program. He expressed openness to the idea last summer and supported a version of a voucher plan earlier in his career. Polis said in a statement Friday that he doesn’t believe vouchers are a good use of public funds and that this tax credit is not a voucher.

States officially opt in by presenting a list of eligible scholarship-granting organizations to the Treasury Department, a step that must wait until rules are finalized next year.

Polis’ decision doesn’t necessarily mean Colorado will participate in the tax-credit program over the long term. Polis is term-limited, and the winner of the governor’s race next year could make a different decision.

Supporters of Polis’ decision agreed that the tax credits present an opportunity for the state to raise millions for students, including to support them in out-of-school opportunities and to pay for transportation and school supplies. Advocates say the tax-credit scholarship program helps students in underperforming schools attend other school options.

Tony Lewis, executive director of the Donnell-Kay Foundation, which works on education policy, said he hopes the tax credit rules allow scholarship-granting organizations the ability to pay for a wide range of activities, such as sports, after-school programs, theater classes, and summer camps. (The Donnell-Kay Foundation also has provided funding to Chalkbeat. Read more about our supporters and our ethics policy here.)

“If we pass up this opportunity to opt in now, we close any possibility of doing good work for public school kids,” he said. “Why not keep your options open?”

The Colorado Children’s Campaign, an advocacy organization, also expressed optimism about the potential to benefit public school students.

And Ready Colorado Executive Director Brenda Dickhoner said the decision means more opportunities for kids, especially those wanting to participate in enrichment programs. The conservative organization focuses on school choice and education reform.

“It’s a way for us to solve this problem of closing this opportunity gap, and making it more equitable for kids to access after school enrichment, whether it’s band or sports or any type of tutoring,” she said in an interview.

The program doesn’t require state investment. Instead, it allows states to decide whether taxpayers can donate funds to scholarship-granting organizations and receive a dollar-for-dollar federal tax credit. Individual taxpayers can claim a credit of up to $1,700 starting in 2027.

Those organizations would give the money to parents to pay for education expenses, such as a students’ private school tuition, books, transportation, and uniforms. Families earning up to 300% of area median income would qualify. That threshold includes well-off families in expensive urban areas but might exclude middle-class families in some rural communities.

Colorado voters in 2024 rejected Amendment 80, which would have enshrined the right to school choice in the state’s Constitution. In 2021, they rejected a measure that would have used marijuana tax dollars to support after-school programs and tutoring.

Polis reiterated his decision to opt in despite pleas from a coalition led by Great Education Colorado that delivered a letter to Polis on Wednesday saying the state should not participate.

The letter said the state should focus on providing more resources to schools and respect voters’ wishes to keep vouchers out of the state.

The group added that the state can and must do better when it comes to public education. “But publicly funded school vouchers are not the way to achieve this,” the letter says.

The letter says studies have shown vouchers provide mixed results in improving student achievement. It also says the program lacks public accountability and allows discrimination against children with disabilities or who identify as LGBTQ+.

“Unlike the private or religious schools that vouchers support, our public schools are obligated to teach all students, holding fast to the American ideal of public education as a springboard to success and as necessary to a well-functioning democracy,” the letter says.

The list of organizations calling on Polis to reject the plan include the Colorado Education Association, Colorado Fiscal Institute, Colorado PTA, Movimiento Poder, and The Bell Policy Center.

Jason Gonzales is a reporter covering higher education and the Colorado legislature. Chalkbeat Colorado partners with Open Campus on higher education coverage. Contact Jason at jgonzales@chalkbeat.org.