Gov. Jared Polis wants to restore K-12 and higher education budgets next year to pre-pandemic levels, after the recession slashed tax revenue and forced the state to make deep cuts this year.

Polis proposed a $35.4 billion budget in the 2021-22 fiscal year, an increase of $3 billion — or 9% over this fiscal year. He plans to put back money into funding for districts, colleges, and universities, and to maintain state financial aid for college students.

As with all things related to the pandemic, the optimistic budget presented on Monday is far from set in stone.

The budget assumes carrying forward money from this year after the state received more robust tax revenues than expected. It also assumes a continued, but unpredictable, economic recovery. And it’s uncertain how the election outcomes will affect funds available to the state.

Whatever the unknowns, by law Polis must release his proposed budget for the next year on the first Monday in November. The budget serves as a jumping-off point for priorities. Legislators on the six-member Joint Budget Committee will release their own budget in the spring.

Polis said his budget accomplishes three things: It restores cuts made because of the pandemic, adds economic stimulus for Coloradans, and stashes away funds for the future.

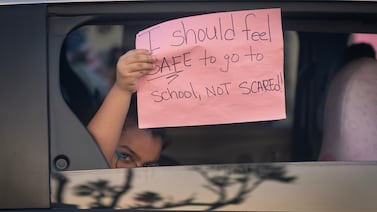

“This budget is for the people of Colorado,” Polis said. “It’s about the challenges that families face with uncertainty in their job, reduced hours, and having to teach a kid at home on and off.”

Related to education, the governor wants to:

- Restore statewide per-pupil funding, increasing funding by $902 per pupil. It would also return the budget stabilization factor — the amount that legislators hold back from what the state constitution mandates for education — to last fiscal year’s level of $572 million. That is a historic low in percentage terms, according to Polis’ office. Since the Great Recession, Colorado lawmakers have withheld more than $8 billion due to schools.

- Maintain $215.6 million in state financial aid that can be tapped by Colorado students.

- Restore cuts amounting to 58% of state funds for the operating budgets of public higher education institutions— $852 million. Polis is proposing to cap tuition increases at 3%.

- Protect key initiatives that include free full-day kindergarten, the Colorado Child Care Assistance Program, and the Colorado Preschool Program. The child care and free preschool program subsidize learning and care for children of low-income families.

- The budget would also provide $50 million to support child care providers.

“The most important investment that we all make as a state, and that we make in our future, is in our children and is in education,” Polis said.

To pay for his priorities, Polis said he will use funds from this year after higher-than-expected revenue. The state predicted a $3.3 billion revenue deficit in May. But sales and income tax collections have been stronger than expected as Colorado’s economic recovery has progressed better than what some feared, at least so far.

Much, however, remains unclear. And Colorado taxpayers are considering several tax amendments that could change how much the state has available to spend — for better or worse.

The most consequential, Amendment B, a repeal of the Gallagher Amendment, is a constitutional provision that is designed to cut taxes on residents, but also shifts that burden to businesses. The provision is labeled as outdated by many lawmakers who say it especially has hurt essential services for rural communities.

The repeal would preserve as much as $490 million in local tax revenue for schools, as well as additional money for firefighters and health care. But if the repeal fails and Gallagher remains in place, the state would face pressure to make up a gap in school funding. That would make it very hard to restore budgets to pre-pandemic levels.

At the same time, the taxpayers may choose to dial back the state’s income tax, which would reduce available funds by 1.2% next fiscal year, or about $150 million.

Taxpayers are also considering increasing taxes on nicotine products, including new taxes on vaping products. The tax would raise millions in funds for education.

Shortly after Polis’ announcement, Democratic members of the Joint Budget Committee applauded the governor for his proposal that “responsibly” restores state support for K-12 and higher education.

Joint Budget Committee Chair Daneya Esgar, a Pueblo Democrat, said the state has a window of opportunity to restore funding after drastic cuts. But she expressed caution.

“We await the results of ballot initiatives and two additional economic forecasts before the budget is finalized, but the goal is right on, helping people,” Esgar said.

JBC member Rachel Zenzinger, an Arvada Democrat, also said there is more work to be done and more that needs to be restored from pandemic-related cuts.

In June, facing a projected $3.3 billion revenue shortfall, lawmakers cut K-12 and higher education by more than $1 billion.